Loading

Get Form Ct-225-a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-225-A online

Filling out the Form CT-225-A online can seem overwhelming, but with a structured approach, it can be manageable. This guide will walk you through each section of the form, ensuring that you provide all necessary information accurately.

Follow the steps to complete Form CT-225-A online.

- Click the ‘Get Form’ button to obtain the form and access it in your online editor.

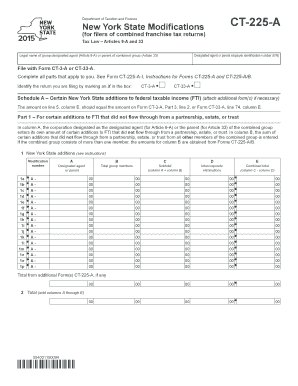

- Begin by entering the legal name of the designated agent or parent of the combined group at the top of the form. Ensure that it matches the documentation you have on file.

- Indicate the return you are filing by marking an X in the appropriate box, either CT-3-A or CT-33-A. This helps in categorizing your submission correctly.

- Proceed to Schedule A where you will document certain New York State additions to federal taxable income. Fill out all relevant columns as instructed, ensuring the figures match those on Form CT-3-A or CT-33-A.

- For Part 1, enter your corporation's amount of additions that did not flow through from other entities. In subsequent columns, combine amounts from other members of the group.

- Continue to Part 2 where you will report on the corporation’s shares of additions from partnerships, estates, or trusts. Again, fill in the designated columns accurately.

- After completing the addition sections, continue to Schedule B to document any subtractions from federal taxable income in a manner similar to the additions.

- Repeat the process for both Part 1 and Part 2 of the subtractions, ensuring all columns are filled as instructed.

- Once all sections are completed, review the form for accuracy. Look for any discrepancies or missing information that could affect your submission.

Complete your online filing of Form CT-225-A today to ensure compliance with state tax regulations.

As applicable, the depreciation modifications disallow the IRC section 168 ACRS/MACRS depreciation deduction and allow a New York State depreciation deduction using any method permitted under IRC section 167.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.