Loading

Get Image Of Local Government Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Image Of Local Government Tax Form online

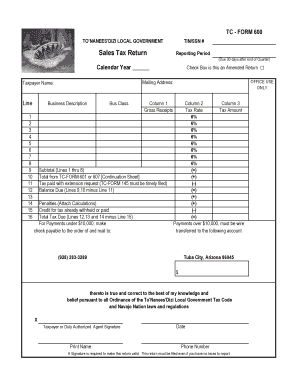

Filling out the Image Of Local Government Tax Form online can simplify your tax reporting process. This guide provides clear instructions on how to effectively complete the form, ensuring you report your sales tax accurately.

Follow the steps to complete your tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter your TIN/SSN number accurately. This is essential for identifying your tax account.

- Specify the reporting period by indicating the calendar year for which you are filing this tax return.

- Provide a brief description of your business in the 'Business Description' field, detailing the nature of your sales.

- Select your business classification in the 'Bus Class' field to categorize your business appropriately.

- In the gross receipts section, record the amounts for each column (Column 1 to Column 8), ensuring each value reflects your total sales accurately.

- The form automatically calculates the tax amount based on your gross receipts and the specified tax rate of 6% for each column.

- Review the subtotal from lines 1 through 8 to ensure accuracy, then proceed to add any amounts from TC-FORM 601 or 607 in line 10.

- If you filed for an extension, include the tax paid with the extension request in line 11. Ensure TC-FORM 145 is filed timely to validate this entry.

- Calculate the balance due by subtracting line 11 from the total of lines 9 and 10. Record this amount in line 12.

- Attach calculations for any interest and penalties and record those amounts on lines 13 and 14 respectively.

- If applicable, deduct any credits for tax already withheld or paid in line 15, and calculate the total tax due by summing lines 12, 13, and 14, then subtracting line 15 to derive the final amount in line 16.

- Indicate your payment method by checking the box if payment is made by wire transfer. Provide the required payment amount in the designated space.

- Sign the form to declare that the information provided is accurate to the best of your knowledge. Include your printed name and contact information.

- Once all sections are complete, save any changes made, and you can choose to download, print, or share the form as needed.

Complete your local government tax form online today to ensure timely and accurate reporting!

3.1 Property tax is an annual tax on real property. It is usually, but not always, a local tax. It is most commonly founded on the concept of market value. The tax base may be the land only, the land and buildings, or various permutations of these factors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.