Loading

Get Tid No 020 Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

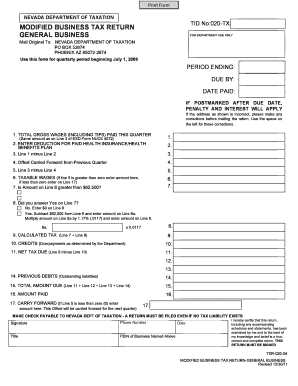

How to fill out the Tid No 020 Tx online

Filling out the Tid No 020 Tx form is essential for reporting your modified business tax obligations accurately. This guide provides clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to accurately complete your Tid No 020 Tx form online.

- Press the ‘Get Form’ button to access the Tid No 020 Tx form and open it in your chosen editor.

- Locate the 'Period Ending' field and enter the appropriate date for the reporting period.

- Move to 'Total Gross Wages (Including Tips) Paid This Quarter' and input the total gross wages you paid during the quarter.

- In the next section, enter any deductions for paid health insurance or health benefits plans you have.

- Calculate Line 3 by subtracting the deduction on Line 2 from the total gross wages entered in Line 1.

- If you have any offsets carried forward from the previous quarter, enter that value in the corresponding section.

- Calculate Line 5 by subtracting the offset listed in Line 4 from Line 3.

- If the result from Line 5 is greater than zero, enter that amount in Line 6. If it is less than zero, enter that value on Line 17.

- Determine if the amount in Line 6 is greater than $62,500. If yes, complete Line 7 and continue to calculate Line 8.

- For Line 8, if you answered yes to Line 7, subtract $62,500 from Line 6 and enter the resulting amount on Line 8a. Multiply that by 1.17% (0.0117) and enter the result in Line 8.

- Add the amount from Line 7 and Line 8 to calculate your calculated tax, which goes in Line 9.

- If applicable, enter any credits (overpayments) determined by the Department in Line 10.

- Calculate your net tax due by subtracting credits in Line 10 from your calculated tax in Line 9. Enter that value in Line 11.

- If you have any previous debits or outstanding liabilities, enter these in Line 14.

- Calculate your total amount due by adding lines 11, 12, 13, and 14 together in Line 15.

- Input the total amount that you are paying in Line 16.

- If you have any carry forward amounts from the previous quarter, enter that on Line 17.

- Ensure to sign and date the form, and provide any necessary contact details such as your title and phone number.

- Finally, review all entries for accuracy before utilizing options to save, download, print, or share the completed form online.

Complete your Tid No 020 Tx form online now for efficient processing.

To comply with NRS 360.203 subsection 4, the MBT tax rate after adjustment will be 1.17 percent for general business (NRS 363B. 110) and 1.554 percent for financial institutions and mining (NRS 363A. 130). These tax rate changes will take effect July 1, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.