Loading

Get Rev 1549 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 1549 Form online

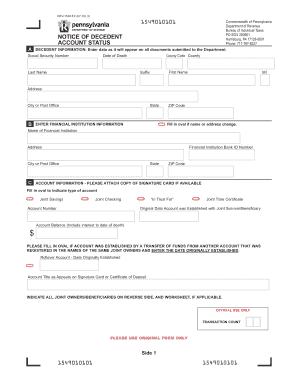

The Rev 1549 Form is an important document for reporting the account status of a decedent. This guide provides clear steps on how to fill out this form online, ensuring you complete it accurately and efficiently.

Follow the steps to fill out the Rev 1549 Form online.

- Click the 'Get Form' button to obtain the form and open it in the online editor.

- Begin by entering the decedent's information in Section A. Provide the date of death in MM/DD/YYYY format, followed by the social security number, county code, last name, first name, middle initial, address, city or post office, state, and ZIP code including the ZIP+4 code.

- In Section B, fill in the financial institution information. Include the name of the financial institution and its bank ID number, as well as the address, city or post office, state, and ZIP code with the ZIP+4 code. Mark the circle if there is a change in the name or address.

- Section C requires the account information. Indicate the type of account by filling in the corresponding oval for joint savings, joint checking, joint time certificate, or other account types. Enter the account number, the account title as it appears on the signature card, and the original date the account was established. Include the account balance including interest accrued up to the date of death.

- Provide details about additional joint owners or beneficiaries on the reverse side of the form, and ensure you attach a copy of the signature card if possible. Note the relationship and share percentage for each survivor listed.

- In the certification section, the preparer should print their name, telephone number, email address, and date in MM/DD/YYYY format to authenticate the form.

- Once all sections are completed, review your entries for accuracy. Save your changes, download the completed form, print for records, or share as needed.

Complete the Rev 1549 Form online today to ensure compliance and proper documentation.

An inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to PA inheritance tax. The tax is due within nine months of the decedent's death.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.