Loading

Get Alc Alc83 Gen 081211.indd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ALC ALC83 GEN 081211.indd online

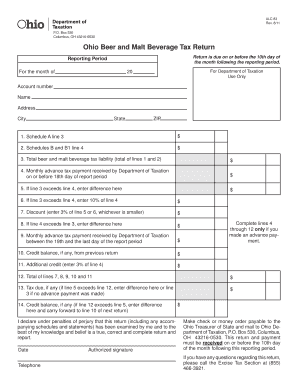

Filling out the ALC ALC83 GEN 081211 form online can seem daunting, but with clear instructions, you can complete the process smoothly. This guide will walk you through each section of the form, ensuring that you understand what information is required and how to provide it accurately.

Follow the steps to complete your online form effectively.

- Click ‘Get Form’ button to access the online version of the ALC ALC83 GEN 081211 form.

- Enter the reporting period for the month in the specified field. This is crucial for ensuring that your tax return is processed on time.

- Fill in your account number, name, address, city, state, and ZIP code in the designated areas to identify your tax account.

- Complete Schedule A line 3 by entering the appropriate amount related to your beer and malt beverage sales.

- For Schedules B and B1, line 4, input the total liability based on the sales and consumption data you have calculated.

- Calculate the total beer and malt beverage tax liability by adding amounts from lines 1 and 2, and ensure this is reflected accurately on line 3.

- If applicable, enter any advance tax payments received by the Department of Taxation on line 4.

- If line 3 exceeds line 4, calculate the difference and enter it in the corresponding field.

- Include calculations for discounts and additional credits as instructed in the respective lines of the form.

- Ensure that all figures are accurate before proceeding to the final step to confirm your data.

- Once you have filled in all necessary sections, you can save your changes, download a copy for your records, print the completed form, or share it as needed.

Complete the ALC ALC83 GEN 081211 form online today to ensure timely filing and compliance with tax obligations.

Food Service Industry – Retail Sale – Ohio Revised Code Food not consumed on premises (“to go” or “take out”) is exempt from sales tax. However, a soft drink is always taxable, no matter where the beverage is consumed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.