Loading

Get Aurora Coa Stm 0101

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aurora Coa Stm 0101 online

Filling out the Aurora Coa Stm 0101 form online can streamline your tax reporting and ensure compliance with local regulations. This guide will provide you with clear steps to accurately complete the form for your business needs.

Follow the steps to complete the Aurora Coa Stm 0101 form effectively.

- Click 'Get Form' button to obtain the form and open it for editing.

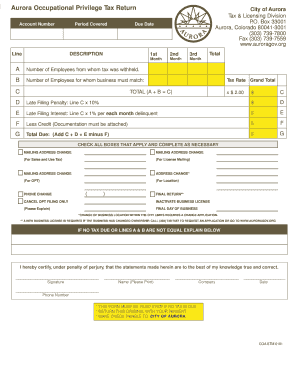

- Locate the account number field and enter your unique identifier for the tax record.

- Indicate the period covered by this tax return. Make sure to specify the appropriate months for which you are reporting.

- Fill in the number of employees from whom tax was withheld in Section A. This is essential for calculating your tax obligations.

- In Section B, provide the number of employees for whom your business must match the reported tax. Ensure this number aligns with your records.

- Calculate the total by adding Section A and Section B together. Enter the result in Section C.

- Multiply the total from Section C by the tax rate, which is $2.00, to arrive at your grand total.

- Calculate the late filing penalty, which is 10% of the total amount calculated in Section C. Enter this amount in Section D.

- Determine any late filing interest owed, which is calculated as 1% per each month the filing is delayed. Input this figure in Section E.

- If you have documentation for any credits, input the amount in Section F.

- Finally, compute the total amount due in Section G by adding the amounts from Sections C, D, and E, and then subtracting Section F.

- If applicable, check any boxes that relate to changes in your mailing address, phone number, or business status and provide explanations as necessary.

- Sign and print your name in the designated area, including your company name and the date of completion.

- Review all entries for accuracy, then save your changes, and download or print the completed form for submission.

Complete your Aurora Coa Stm 0101 form online today to ensure timely and accurate tax reporting.

Occupational Privilege Tax (OPT) withholding in the state of Colorado is not considered an income tax and therefore is not reported on the Form W-2. OPT localities within Colorado include: Denver, Aurora, Greenwood Village, Glendale, and Sheridan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.