Loading

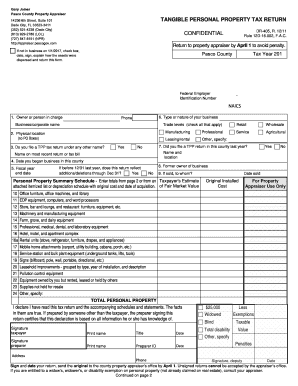

Get Pasco County Tangible Personal Property Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pasco County Tangible Personal Property Tax Return online

Filing your Tangible Personal Property Tax Return is crucial for ensuring compliance with local tax regulations. This guide provides clear, step-by-step instructions for completing the Pasco County Tangible Personal Property Tax Return online, making the process simpler and more accessible for all users.

Follow the steps to complete your tax return efficiently.

- Click 'Get Form' button to obtain the form and open it for editing.

- Begin by filling in your business name (DBA—Doing Business As) and mailing address. Ensure that this information is accurate; if incorrect, make the necessary corrections.

- Provide your Federal Employer Identification Number and NAICS code relevant to your business. This information is essential for tax identification purposes.

- Identify the owner or responsible person in charge of the business by providing their name and contact number. Make sure this person is available for any inquiries regarding the return.

- Indicate the physical location of your business. Note that P.O. Boxes are not acceptable, and you must provide a physical address.

- Detail the type or nature of your business by checking the appropriate boxes for options like manufacturing, retail, service, and more.

- Specify if you filed a Tangible Personal Property return under any other name and if you filed in the county last year.

- Report your personal property summary on page 1, entered totals should reflect accurate estimates or original costs from your itemized list.

- Sign the return and print your name, title, and date. If someone else prepared the return, they also need to provide their signature, print their name, preparer ID, and date.

- Review all entries for completeness and accuracy. Ensure you have recorded all necessary assets and provided fair market values as required.

- Once you have completed the form, you can save your changes, download the form, print it for mailing, or share it electronically if permitted.

Start completing your Pasco County Tangible Personal Property Tax Return online today to ensure timely and accurate filing.

Tangible Personal Property (TPP) is everything other than real estate that has value by itself. Florida Statute defines TPP as “all goods, chattels, and other articles of value (but does not include vehicular items) capable of manual possession and whose chief value is intrinsic to the article itself.”

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.