Loading

Get Reply To Ftb Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reply To FTB Questionnaire online

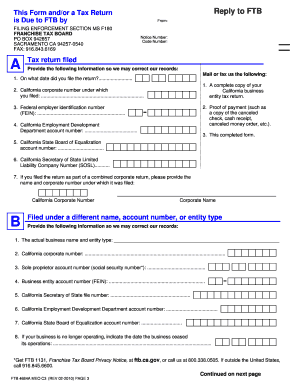

Completing the Reply To FTB Questionnaire online is an essential process for ensuring your tax records are accurate. This guide will walk you through each section of the form, providing clear instructions and supportive guidance.

Follow the steps to successfully complete the questionnaire.

- Press the ‘Get Form’ button to access the Questionnaire. This will allow you to obtain the form and open it for completion.

- In the 'From' section, fill in your Notice Number and Code Number. These details are crucial for FTB to identify your records accurately.

- Provide the date you filed your tax return. This helps correct any discrepancies in your filing records.

- Submit a complete copy of your California business entity tax return. This documentation will be necessary for FTB's review.

- Fill in your California corporate number, Federal Employer Identification Number (FEIN), California Employment Development Department account number, and other relevant identifiers as requested.

- If applicable, provide information regarding any business names or account numbers under which the return was filed.

- Describe your business activities in California. Be specific about the nature of your business and provide details about where and how activities are conducted.

- Answer the Yes/No questions regarding your business presence and activities in California, providing additional information as needed.

- Once you have completed all sections, review the questionnaire for accuracy and completeness.

- Finally, save your changes, download the form, and consider printing or sharing it as needed to ensure it is submitted properly.

Complete your documents online today to maintain your compliance with FTB requirements.

Available weekdays: 8 AM to 5 PM PT (general and MyFTB) 8 AM to 5 PM PT (levy, lien, wage garnishment, installment agreement, or revive, dissolve, or suspended business)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.