Loading

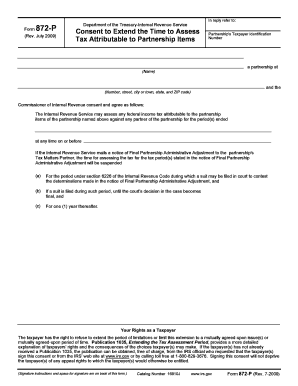

Get Form 872-p (rev. 7-2009). Consent To Extend The Time To Assess Tax Attributable To Partnership Items

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 872-P (Rev. 7-2009). Consent to extend the time to assess tax attributable to partnership items online

Filling out Form 872-P is an essential step for partnerships wishing to extend the time to assess tax attributable to partnership items. This guide will provide you with clear and easy-to-follow instructions on how to complete the form online efficiently.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the document and open it in the designated editor.

- Locate the section for entering the partnership's taxpayer identification number. Provide the accurate number, as it is crucial for identification purposes.

- In the next field, type the name of the partnership along with the complete address, including the number, street, city or town, state, and ZIP code.

- Fill in the periods ended with the tax period(s) you are referencing in the document.

- Acknowledge the consent by checking the boxes and understanding the implications of allowing the IRS to assess the federal income tax.

- Provide the date by which the IRS may assess the tax. Make sure this date aligns with your understanding and agreements.

- The tax matters partner or authorized representative will need to sign the form. Ensure they include their title and the date signed accordingly.

- If an authorized person is signing on behalf of the tax matters partner, attach the necessary written authorization as described in the instructions.

- Once all sections are thoroughly completed and reviewed for accuracy, save your changes. You can then download, print, or share the completed form as needed.

Begin filling out your Form 872-P online today for a seamless tax assessment process.

8.19.1.6.5 Tax Matters Partner (TMP)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.