Loading

Get 00-941 Texnet Change Form. 00-941 Texnet Change Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 00-941 TEXNET Change Form online

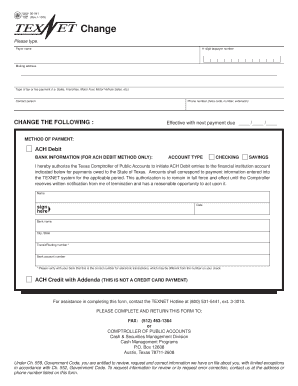

Filling out the 00-941 TEXNET Change Form is an essential process for updating your payment information with the Texas Comptroller of Public Accounts. This comprehensive guide will assist you in navigating the form with clarity and ease, ensuring that you provide all necessary information accurately.

Follow the steps to successfully complete the 00-941 TEXNET Change Form.

- Press the ‘Get Form’ button to access the 00-941 TEXNET Change Form and open it for completion.

- Begin by entering your payor name in the appropriate field, followed by your 11-digit taxpayer number to identify your account.

- Provide your mailing address to ensure all correspondence reaches you. This is important for maintaining accurate records.

- Indicate the type of tax or fee payment you are updating, such as Sales, Franchise, or Motor Fuel, to give context to your request.

- Include the name of a contact person who can be reached regarding this submission, along with a valid phone number, including area code and extension if necessary.

- Specify the effective date for your changes, ensuring it is noted as the next payment due date.

- Select the method of payment you wish to use. If you choose ACH Debit, fill out the bank information section, including the account type (Checking or Savings), bank name, city and state, transit/routing number, and bank account number.

- Read and acknowledge the authorization for ACH Debit entry by signing your name and including the date of the authorization.

- If opting for ACH Credit with Addenda, ensure this is noted clearly and remember that it is not a credit card payment.

- Upon completing all required fields, review your entries for accuracy before saving changes or downloading the form. You can also choose to print or share it as needed.

Complete your 00-941 TEXNET Change Form online today to ensure your payment information is up to date.

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.