Loading

Get Odjfs Disposition Of Business Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Odjfs Disposition Of Business Form online

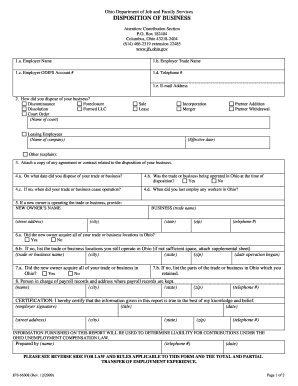

The Odjfs Disposition Of Business Form is essential for reporting the closure or transfer of a business in Ohio. This guide provides step-by-step instructions on how to complete the form online, ensuring that you provide accurate and comprehensive information.

Follow the steps to effectively complete the Odjfs Disposition Of Business Form online.

- Click the ‘Get Form’ button to access the Odjfs Disposition Of Business Form and open it in your preferred document editor.

- In section 1, provide your details: fill in your employer name, trade name, ODJFS account number, telephone number, and email address.

- In section 2, indicate how you disposed of your business by selecting one of the options, such as discontinuance, foreclosure, dissolution, or other, and provide additional details as necessary.

- Ensure to attach a copy of any relevant agreements or contracts related to the disposition of your business as requested in section 3.

- For section 4, enter the date you disposed of your business and answer whether the business was operated in Ohio at the time of disposition. If not, provide the date operations ceased and the date of your last employment of workers in Ohio.

- Section 5 requires you to enter the new owner's name, business trade name, and address details including street, city, state, and zip code, along with their telephone number.

- In section 6, answer whether the new owner acquired all your trade or business locations in Ohio. If not, list the locations you still operate, including the business name and the date operation began.

- For section 7, indicate whether the new owner acquired all parts of your trade or business in Ohio, and if not, list which parts you have retained.

- Complete section 8 by providing the name of the person in charge of payroll records and their address.

- Finally, ensure the certification section is completed: have the employer sign, indicate their title, date, address, and contact number.

- After completing the form, you can save your changes, download the document, and print or share it as needed.

Take the next step and complete your Odjfs Disposition Of Business Form online today.

Taxpayers must report any income even if they did not receive their 1099 form. However, taxpayers do not need to send the 1099 form to the IRS when they file their taxes. In other words, the IRS receives the 1099, containing the taxpayer's Social Security number, from the issuer or payer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.