Loading

Get Instructions For Completing Pv-st Sales And Use Tax Payment Voucher

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Completing PV-ST Sales And Use Tax Payment Voucher online

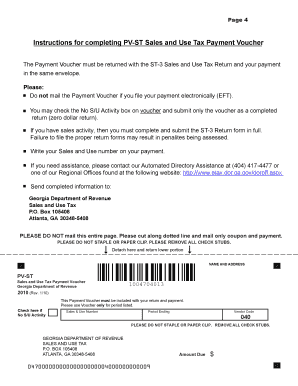

Filling out the PV-ST Sales And Use Tax Payment Voucher accurately is essential for ensuring proper tax compliance. This guide provides you with step-by-step instructions for completing the form correctly and submitting it as required.

Follow the steps to properly complete the payment voucher online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by filling in your name and address in the designated fields on the voucher.

- Locate the Sales & Use number field. Enter your unique Sales and Use number to ensure proper identification.

- Fill out the 'Period Ending' field with the appropriate date that corresponds to the tax period you are reporting.

- If applicable, enter your vendor code (040). This code is utilized for processing your payment.

- Indicate if there was no sales and use activity during the reporting period by checking the 'No S/U Activity' box.

- In the 'Amount Due' field, provide the total amount you are remitting for this payment.

- After completing the form, review all entries for accuracy to avoid any penalties due to incorrect information.

- You can now save your changes, download the completed form, print it, or share it as needed.

Complete your PV-ST Sales And Use Tax Payment Voucher online today for timely submission.

Related links form

Master accounts should file their sales and use tax return online using the Georgia Tax Center (https://gtc.dor.ga.gov). 5% (. 05) of the tax due or five dollars ($5.00), whichever is greater, for the state and for the local taxes will be billed after the return is processed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.