Loading

Get 499r-2c/w-2cpr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 499R-2C/W-2CPR online

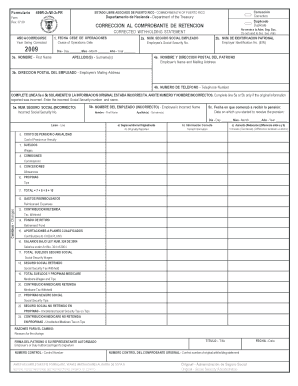

Filling out the 499R-2C/W-2CPR form online can be straightforward if you understand its components. This guide provides step-by-step instructions to help users complete the form effectively.

Follow the steps to fill out the 499R-2C/W-2CPR online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the cease of operations date in the designated field labeled 'FECHA CESE DE OPERACIONES'. Specify the year that is being corrected in 'AÑO A CORREGIRSE'.

- Input the employee's Social Security number in section 'NUM. SEGURO SOCIAL EMPLEADO' and the employer identification number (EIN) in 'NUM. DE IDENTIFICACION PATRONAL'.

- Fill in the employee's first name 'NOMBRE' and surname 'APELLIDO(S)' in sections 3a.

- Provide the employer's name and mailing address in section 4a, and the employee's mailing address in section 3b.

- Complete line 5a or 5b only if the original information was incorrect. Enter the incorrect Social Security number or name as necessary.

- Enter the cost of pension or annuity in section 6, followed by wages in section 7, commissions in section 8, allowances in section 9, and tips in section 10.

- Calculate the total by summing up sections 7, 8, 9, and 10 in section 11.

- Proceed to complete the remaining relevant sections, including reimbursed expenses, tax withheld, and contributions to retirement funds.

- At the end of the form, sign as the employer or authorized agent, and complete the control number fields.

- Before finalizing the form, check all entries for accuracy. Users can save changes, download, print, or share the completed form.

Start filling out your documents online today.

To get copies of your current tax year federal Form W-2 contact your employer; contact the Social Security Administration (SSA); or. visit the IRS at Transcript or copy of Form W-2 for information. The IRS provides the following guidance on their website:

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.