Loading

Get Form Itps-coa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM ITPS-COA online

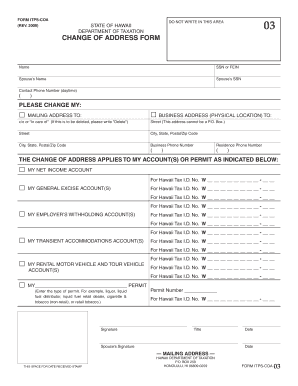

Filling out the FORM ITPS-COA is a straightforward process that allows users to update their address with the Hawaii Department of Taxation. This guide provides step-by-step instructions to ensure that your information is submitted accurately and efficiently.

Follow the steps to complete the FORM ITPS-COA online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your name in the designated field. Ensure that the name is spelled correctly, as it should match your legal identification.

- Provide your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the corresponding field.

- Input your spouse’s name and their SSN if applicable, or skip this if you are not reporting a spouse.

- Enter your daytime contact phone number accurately, ensuring the area code is included.

- Indicate whether you wish to change your business address or mailing address by checking the appropriate box.

- For the selected address, fill out the street address, city, state, and postal/zip code. Ensure that the address is not a P.O. Box.

- If applicable, provide the business phone number and residence phone number in the required fields.

- Identify which account(s) or permit your change of address applies to by checking the relevant boxes, and provide the corresponding Hawaii Tax I.D. numbers.

- If changing an address for a specific permit, write the type of permit in the provided space.

- Sign and date the form in the designated signature fields, and if a spouse's signature is required, have them sign as well.

- Once all required fields are completed, review your entries to ensure accuracy, then save any changes. You can choose to download, print, or share the completed form as needed.

Start completing your FORM ITPS-COA online today!

The state of Hawaii requires you to pay taxes if you are a resident or nonresident and receive income from a Hawaii source. The state income tax rates range from 1.4% to 11%, and the Aloha State doesn't charge sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.