Loading

Get Form Ft-504

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form FT-504 online

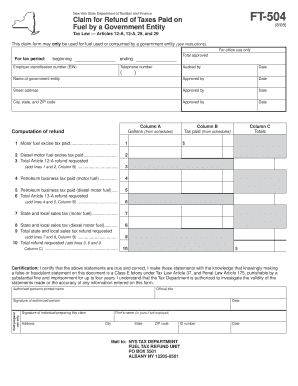

This guide provides a comprehensive overview of how to successfully fill out the Form FT-504, which is used by government entities in New York to claim refunds on fuel taxes paid. Follow these instructions carefully to ensure accurate completion of the form online.

Follow the steps to complete the Form FT-504 online.

- Press the ‘Get Form’ button to obtain the form and open it in your document management tool.

- Begin by entering the tax period at the top of the form, indicating the start and end dates.

- Fill in the employer identification number (EIN) and provide the telephone number for the government entity.

- Enter the name of the government entity along with the street address, city, state, and ZIP code.

- Proceed to Column A and input the gallons of motor fuel and diesel motor fuel used, as derived from your schedules.

- Completion of refund calculations is essential: input the tax amounts on lines 1 and 2 for excise tax paid, and then calculate the total refund requested for Article 12-A by adding these amounts on line 3.

- Continue to fill out the petroleum business tax amounts in Column A, submitting the values for both motor and diesel fuel on lines 4 and 5, and total these on line 6.

- Record the state and local sales tax for both types of fuel in Column A on lines 7 and 8 and calculate the total sales tax refund requested on line 9.

- To conclude, aggregate the total refund requested across all categories on line 10.

- In the certification section, print the name of the authorized person, include their official title, and obtain their signature along with that of the individual preparing the claim.

- Finally, review all information for accuracy, save your changes, and you can choose to download, print, or share the completed form.

Complete and submit your tax refund claims online today!

Who is eligible for the sales tax refund? Full-year Colorado residents who were 18 or older as of Jan. 1, 2022, can get this refund by filing by April 18. If you file an extension, there are more limitations on whether you can claim it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.