Loading

Get 2007 Form 4626. Alternative Minimum Tax--corporations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 Form 4626. Alternative Minimum Tax--Corporations online

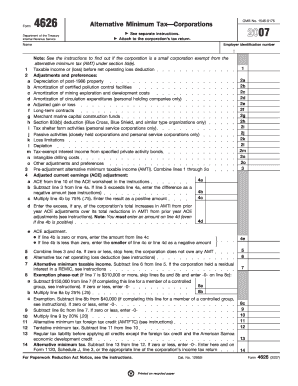

Filling out the 2007 Form 4626 is essential for corporations subject to the alternative minimum tax. This guide provides a clear, step-by-step approach to assist users in completing the form accurately and efficiently online.

Follow the steps to successfully fill out the form online.

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Fill in the corporation's name and employer identification number (EIN) at the top of the form.

- Report the taxable income or loss before any net operating loss deductions. This information is critical for the calculation of alternative minimum tax.

- Complete the adjustments and preferences section. This includes reporting various items such as depreciation, amortization, and other modifications as specified.

- Combine all relevant adjustments from lines 1 through 2o to determine your pre-adjustment alternative minimum taxable income (AMTI).

- Review the adjusted current earnings (ACE) adjustment. Enter the required figures according to the ACE worksheet instructions, including calculations for lines 4a through 4e.

- Calculate the alternative minimum tax foreign tax credit (lines 11 and 12) to offset possible alternative minimum tax obligations.

- Determine the final alternative minimum tax by subtracting the regular tax liability from the tentative minimum tax on line 14.

- Once all sections are completed, save your changes and prepare to download, print, or share the filled-out form as needed.

Complete your document filing process online with confidence today.

The Inflation Reduction Act of 2022 (P.L. 117-169) imposes a corporate alternative minimum tax (CAMT) of 15% on the adjusted financial statement income of large corporations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.