Loading

Get G-7/schb Quarterly Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G-7/SchB Quarterly Return online

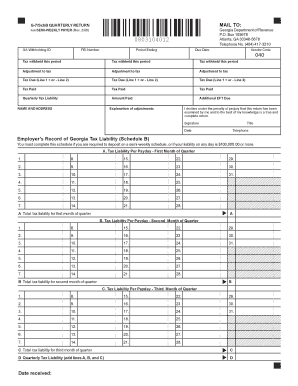

Filing the G-7/SchB Quarterly Return is an essential task for ensuring compliance with tax obligations in Georgia. This guide provides clear steps to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the G-7/SchB Quarterly Return form.

- Click the ‘Get Form’ button to retrieve the G-7/SchB Quarterly Return form and open it in the online editor.

- Enter your Georgia withholding ID and FEI number in the designated fields at the top of the form. Make sure these numbers are accurate to avoid any processing issues.

- Indicate the period ending date and due date for the return. This ensures that your submission is timely and relevant to the correct reporting period.

- Fill in the vendor code, which is necessary for processing your taxes correctly. This code can be found on your previous tax documents or through your tax account.

- Report the total tax withheld for this period in the appropriate fields. You may need to repeat this for different employee groups or payroll cycles, as indicated.

- Make note of any adjustments to tax, including increases or decreases, in the adjustment fields. Clearly describe the reasons for any changes in the explanation area provided.

- Calculate the total tax due by adding or subtracting adjustments from the tax withheld amounts. Double-check your calculations to ensure accuracy.

- Record the total amount paid and any additional EFT due in the specified fields to finalize your payment details.

- Complete the employer’s record of Georgia tax liability (Schedule B), ensuring that you consist of each payday's tax liability across the three months of the quarter.

- Review the declaration section at the bottom of the form. Ensure you sign and date the document, and provide your title and telephone number where required.

- After thoroughly reviewing your entries, save your changes. You may choose to download, print, or share the form as needed.

Complete your G-7/SchB Quarterly Return online today for a seamless filing experience.

G-7Q Withholding Quarterly Return (For Quarterly Payer)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.