Loading

Get Form Op-161, Petroleum Products Gross Earnings Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form OP-161, Petroleum Products Gross Earnings Tax Return online

This guide provides clear, step-by-step instructions for filling out the Form OP-161, which is essential for reporting gross earnings from petroleum products in Connecticut. Whether you are familiar with tax forms or new to the process, this guide will support you in completing the return accurately online.

Follow the steps to complete your tax return online.

- Press the ‘Get Form’ button to receive the form and display it for editing.

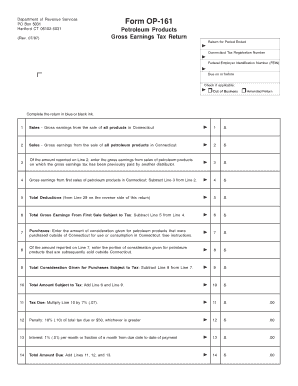

- Enter the Connecticut Tax Registration Number into the appropriate field to ensure your business is correctly identified.

- Provide your Federal Employer Identification Number (FEIN) in the designated section. This number helps in tracking your business for federal tax purposes.

- Complete the return using blue or black ink. For online submissions, ensure that all details are entered clearly.

- In Line 1, report total gross earnings from all products sold in Connecticut. Input the total amount in the designated space.

- In Line 2, specifically document gross earnings from the sales of petroleum products in Connecticut.

- If applicable, record any gross earnings from petroleum products that have previously been taxed by another distributor in Line 3.

- Calculate your gross earnings from first sales of petroleum products by subtracting Line 3 from Line 2, and input that total in Line 4.

- Document total deductions on Line 5, which should be taken from Line 29 on the reverse side of the form.

- Determine total gross earnings subject to tax by subtracting Line 5 from Line 4; record this in Line 6.

- For purchases, enter the total consideration paid for petroleum products purchased outside of Connecticut in Line 7.

- If any of these products were sold outside Connecticut, report that amount in Line 8.

- Subtract Line 8 from Line 7 for your total consideration of purchases subject to tax, recording it in Line 9.

- To calculate the total amount subject to tax, add the amounts from Lines 6 and 9, and enter the total in Line 10.

- Multiply the total in Line 10 by 7% (0.07) to find the tax due, and record that amount in Line 11.

- Calculate any penalties on Line 12 — either 10% of the tax due or a flat $50, whichever is greater.

- Compute interest from the due date to payment date on Line 13 at a rate of 1% per month.

- Lastly, sum the amounts from Lines 11, 12, and 13 on Line 14 for your total amount due.

- On the declaration section, affirm the truthfulness of your return with your signature, title, date, and compelling contact details.

- Once completed, save changes to your document. You may then download, print, or share the form as needed.

Complete and submit your Form OP-161 online today to ensure compliance with your tax obligations.

Gas tax and price in select U.S. states 2022 California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.