Loading

Get Sales Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales Tax Return online

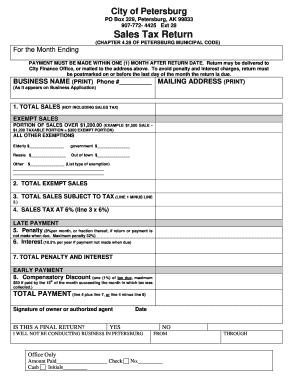

Completing the Sales Tax Return online is a straightforward process that requires careful attention to detail. This guide will walk you through each section and field of the form, ensuring you understand what information to provide.

Follow the steps to complete the Sales Tax Return accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your business name, phone number, and mailing address as it appears on your Business Application. Ensure this information is accurate to avoid any issues with your return.

- In the first section, 'Total sales (not including sales tax)', enter your total sales amount. This should reflect the gross sales made throughout the month.

- Identify any exempt sales, such as elderly, government, resale, out of town, or other exemptions. Specify the amounts for each exemption where applicable.

- Total the exempt sales and record this amount in the designated area. This total will be used to calculate your taxable sales.

- Subtract the total exempt sales from the total sales to find the total sales subject to tax. Record this amount on the form.

- To calculate the sales tax owed, multiply the total sales subject to tax by 6%. Write this amount in the appropriate section for sales tax.

- Review the late payment section. If applicable, calculate any penalties or interest owed based on the due dates and record these amounts.

- If you qualify for an early payment discount, enter the discount amount as specified on the form.

- Calculate the total payment due by adding the sales tax and any penalties or interests, then subtracting any discounts. Write this final amount on the form.

- Sign and date the form where indicated. If this is a final return, check the appropriate box.

- Finally, review your completed form for accuracy, and save your changes. You can download, print, or share your completed Sales Tax Return online.

Get started by filling out your Sales Tax Return online today!

Indirect tax is called sales tax in the US, value-added tax (VAT) in Europe, goods and services tax (GST) in Australia and consumption tax (JCT) in Japan. The process for collecting these taxes can vary significantly, but the outcome is the same: The end customer pays the tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.