Loading

Get 2006 Business Privilege Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Business Privilege Tax online

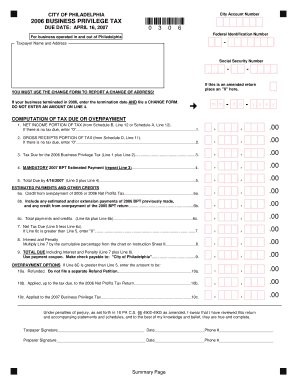

Completing the 2006 Business Privilege Tax form online can simplify your filing process. This guide provides clear and supportive instructions for filling out each section of the form, ensuring that you can navigate the requirements effortlessly.

Follow the steps to complete the online form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Enter your City Account Number at the top of the form. This unique number is essential for identifying your business tax account.

- Input your Federal Identification Number, or Social Security Number if applicable, in the designated field to establish your business identity.

- If you are amending a previous return, mark the appropriate box. If your business has terminated, enter the termination date and ensure to file a change form.

- Complete the Computation of Tax Due or Overpayment section by entering the net income portion and gross receipts portion based on your calculations from the corresponding schedules.

- Carry over total amounts due and any credits from prior tax payments in the Estimated Payments and Other Credits section.

- Calculate the net tax due by subtracting total payments and credits from the total due. Include any interest and penalties if applicable.

- Review the overpayment options if applicable and choose how you would like the overpayment handled, either as a refund or applied to future taxes.

- Sign and date the form where indicated to validate your submission, ensuring to provide contact information.

- Once all fields are completed, save your changes, and you may download, print, or share the completed form as necessary.

Start filing your documents online today to ensure timely tax compliance.

For many businesses, privilege tax may also be referred to as franchise tax. Franchise or privilege tax is a tax certain business owners have to pay to conduct business and operate in a state. Some states charge this tax for the privilege of doing business in a state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.