Loading

Get Sc 1041 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC 1041 Instructions online

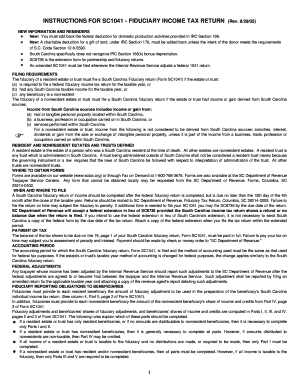

Completing the SC 1041 fiduciary income tax return can be straightforward with the right guidance. This guide offers clear, step-by-step instructions to help you efficiently fill out the SC 1041 Instructions online, whether you are a seasoned filer or new to fiduciary tax matters.

Follow the steps to complete the SC 1041 Instructions online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing the name, address, and federal identification number of the estate or trust at the top of the form. Answer all initial questions to confirm your filing status.

- On Line 1, enter the federal taxable income shown on your federal fiduciary return. For nonresident estates or trusts, report the figures according to the specific instructions provided.

- Proceed to Line 2, entering the fiduciary exemption claimed on the federal return as required.

- For Line 3, include any modifications related to principal or non-distributable income that apply based on the explanations in the instructions.

- On Line 4, if applicable, enter the South Carolina fiduciary adjustment to account for any adjustments from Line 1.

- Calculate the net amount on Line 5 by combining the figures from Lines 1, 2, 3, and 4.

- Complete Lines 6 to 11 to determine the South Carolina taxable income and any applicable credits, ensuring you reference the tax computation schedule for Line 8.

- Finalize the form by entering payment details in Line 19, sign the return, and ensure a copy of your federal return is included.

- Once all sections are complete, save your changes, download or print the finished form as needed, or share it with the necessary parties.

Start filling out your SC 1041 Instructions online today to ensure accurate and timely submission!

Form 1041: Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate's tax year. For example, for a trust or estate with a tax year ending December 31, the due date is April 15 of the following year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.