Loading

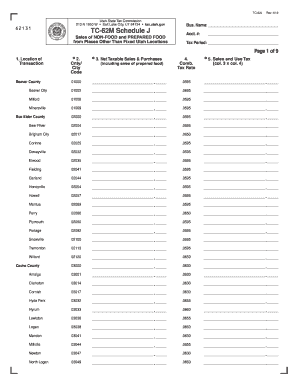

Get Tc-62m, Schedule J

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC-62M, Schedule J online

Filling out the TC-62M, Schedule J can seem challenging, but with the right guidance, you can complete it confidently and accurately. This guide provides a step-by-step approach to help you fill out this form online, ensuring you meet all necessary requirements for reporting sales of non-food and prepared food from locations other than fixed Utah locations.

Follow the steps to successfully complete the TC-62M, Schedule J online.

- Press the ‘Get Form’ button to obtain the TC-62M, Schedule J and open it in the designated editor.

- In the first section, 'Location of Transaction', enter the specific location where the sales occurred. Ensure that you provide accurate information as this is crucial for tax reporting.

- In the 'County/City Code' field, input the appropriate code corresponding to the location of the transaction. This information helps in identifying the sales tax jurisdiction.

- Proceed to fill in the 'Net Taxable Sales & Purchases' section, including sales of prepared food. Carefully calculate and input the total amount here.

- Next, in the 'Combined Tax Rate' field, find and enter the correct tax rate based on the location of your transaction. Refer to a current tax rate chart if needed to ensure accuracy.

- Calculate the 'Sales and Use Tax' by multiplying the amount from the 'Net Taxable Sales & Purchases' (column 3) by the 'Combined Tax Rate' (column 4). Enter this total in the designated field.

- Repeat these steps for each location of transaction you need to report, ensuring that all entries are complete and accurate.

- Once you have filled out all necessary fields, you can save any changes made, and choose to download, print, or share the completed form as needed.

Begin filling out the TC-62M, Schedule J online now to ensure accurate tax reporting.

Restaurants with Grocery Food Sales In Utah, sales of prepared food for immediate consumption are subject to the full sales tax rate in the jurisdiction where the sale occurs. Sales of grocery food (unprepared food and food ingredients) are subject to a lower 3 percent rate throughout Utah.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.