Loading

Get G7 Schb Quarterly Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G7 Schb Quarterly Return online

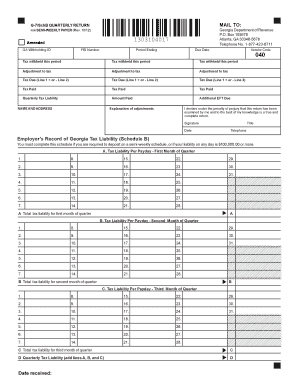

The G7 Schb Quarterly Return is a crucial document for reporting certain tax liabilities to the Georgia Department of Revenue. This guide will provide you with step-by-step instructions on how to accurately complete the form online.

Follow the steps to successfully complete the G7 Schb Quarterly Return.

- Click the ‘Get Form’ button to access the G7 Schb Quarterly Return form. This will allow you to download the document and fill it out in an online format.

- Begin by entering your Georgia Withholding ID and Federal Employer Identification Number (FEI) in the designated fields. This information helps identify your account with the Department of Revenue.

- Next, specify the period ending date and the due date for the return to ensure timely submission. Accurate dates help prevent penalties.

- Indicate if you are a semi-weekly payer by checking the appropriate box. This will determine your filing requirements and payment schedules.

- In the 'Tax withheld this period' section, enter the amounts of tax withheld for each relevant pay period. Make sure that these figures reflect your accurate payroll records.

- Record any adjustments to tax withheld in the 'Adjustment to tax' fields. Adjustments may be necessary to correct previous filings or to account for any discrepancies.

- Calculate the total tax due by adding or subtracting adjustments, as indicated in the 'Tax Due' field. Ensure that the calculations are correct for your records.

- Next, indicate the total tax paid for the period in the 'Tax Paid' section. This should reflect the actual payments made toward your tax liabilities.

- In the 'Quarterly Tax Liability' field, summarize your total tax liability accumulated over each month in the quarter by adding the figures from each month's payday listings in Schedule B.

- Finally, fill in your name, address, and contact information. Sign and date the form to certify that all provided information is true and complete.

- Once completed, save any changes you have made to the form. You can then download, print, or share the G7 Schb Quarterly Return as needed to submit to the Georgia Department of Revenue.

Complete your G7 Schb Quarterly Return online today and ensure compliance with the Georgia Department of Revenue.

This form is for Production Companies withholding Georgia income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.