Loading

Get Refund Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Refund Application Form online

This guide provides you with step-by-step instructions to complete the Refund Application Form online. It aims to simplify the process and ensure you have all necessary information ready for submission.

Follow the steps to successfully complete the Refund Application Form.

- Click ‘Get Form’ button to obtain the Refund Application Form and open it in your online editor.

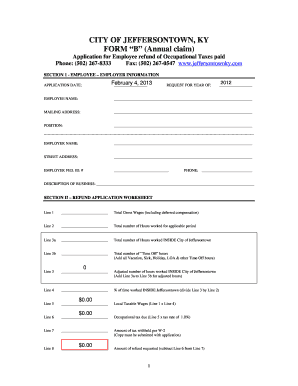

- In Section 1, fill in your employee and employer information. Provide the application date, the year for which you are requesting a refund, your name, mailing address, position, and your employer's name, address, and federal ID number.

- In Section II, complete the Refund Application Worksheet. Start with Line 1, enter your total gross wages, then detail the total number of hours worked for the applicable period in Line 2.

- On Line 3, break down your hours by indicating the total hours worked inside Jeffersontown (Line 3a) and the total 'Time Off' hours (Line 3b). Add these for the adjusted number of hours worked inside Jeffersontown (Line 3).

- Calculate the percentage of time worked inside Jeffersontown by dividing Line 3 by Line 2 (Line 4).

- Compute the occupational tax due by multiplying the result on Line 5 by the tax rate of 1.0% for Line 6.

- Input the amount of tax withheld per W-2 on Line 7. Ensure you attach a copy of the W-2 with your application.

- Next, calculate local taxable wages by multiplying Line 1 by Line 4 for Line 8. Finally, determine the amount of refund requested by subtracting Line 6 from Line 7.

- Section III requires you to certify that the information is accurate. Sign in the designated area, and prepare to have your signature notarized.

- For Section IV, the authorized officer of your employer must certify and sign to confirm the percentage of hours worked inside Jeffersontown.

- In Section V, review general information about statements for work outside of Jeffersontown, which might be needed during the audit.

- Once completed, save any changes you made, and you can choose to download, print, or share the Refund Application Form as necessary.

Complete your Refund Application Form online today for a smooth submission process.

An individual, estate, or trust files Form 1045 to apply for a quick tax refund resulting from: The carryback of an NOL.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.