Loading

Get Ow-15-a. Ow-15-a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OW-15-A online

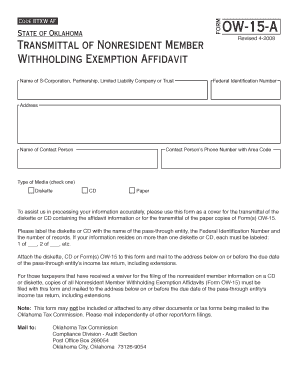

The OW-15-A form is crucial for the transmittal of nonresident member withholding exemption affidavits. This guide provides comprehensive, step-by-step instructions to assist you in accurately completing and submitting the form online.

Follow the steps to complete the OW-15-A form correctly.

- Press the ‘Get Form’ button to access the OW-15-A document and open it in your editing platform.

- Begin by entering the name of the S-Corporation, partnership, limited liability company, or trust in the designated field.

- Next, input the federal identification number associated with the entity.

- Provide the complete address of the entity in the appropriate section.

- Fill in the name of the contact person who will handle the submission.

- Enter the contact person's phone number, ensuring to include the area code.

- Select the type of media you are using for the transmittal by checking the corresponding box (diskette, CD, or paper).

- When using a diskette or CD, label it with the entity's name, federal identification number, and number of records, ensuring any additional disks or CDs are labeled appropriately.

- Attach the diskette, CD, or paper copies of Form(s) OW-15 to this form and prepare for mailing.

- Mail the completed OW-15-A form to the Oklahoma Tax Commission at the specified address, making sure to do so independently of other documents.

- Finally, save your changes, and if needed, download, print, or share the form.

Complete your OW-15-A form online today to ensure timely submission and compliance.

The withholding rate is $9.35 plus 4.75% of the net amount of the wage payment that is over $1,038.00.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.