Loading

Get 8944 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8944 Form online

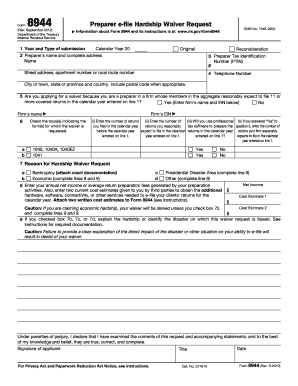

The 8944 Form is essential for preparers seeking a waiver for e-filing hardship. This guide will support users as they navigate the process of completing the form online, ensuring accuracy and efficiency.

Follow the steps to complete the 8944 Form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the calendar year in the corresponding field. Specify if this is an original submission or a reconsideration request.

- Fill out the preparer's name and complete address in the designated sections, including street address and postal code.

- Input the Preparer Tax Identification Number (PTIN). Ensure that the number is accurate to prevent processing delays.

- Provide the preparer's telephone number for potential follow-up.

- Specify whether you are applying for a waiver because your firm expects to file 11 or more covered returns. If yes, enter the firm's name and Employer Identification Number (EIN).

- Check the box indicating the specific forms for which you are requesting the waiver. If multiple forms are applicable, check all that apply.

- Indicate the number of returns filed in the previous calendar year and reasonable expectations for the current year. Also, state if you will use professional tax software to prepare the returns.

- Select the reason for the hardship waiver request. If economic hardship is claimed, complete the sections regarding annual net income and cost estimates.

- Provide a detailed explanation of the hardship or disaster in the specified section, ensuring all required documentation is attached.

- Sign and date the form, confirming the accuracy of the information provided under penalties of perjury.

- Finally, save your changes, and download, print, or share the completed form as needed.

Begin filling out your 8944 Form online today to ensure timely processing of your waiver request.

IRS debt relief is for those with $50,000 or less debt. For married couples, tax debt forgiveness is available if their solo income is below $100,000 or $200,000. You can also apply for the IRS debt forgiveness program if you're self-employed and have experienced at least a 25% loss of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.