Loading

Get Form Cg-100-p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CG-100-P online

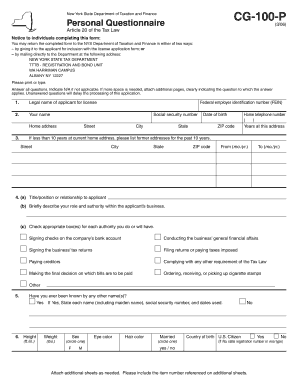

Filling out the Form CG-100-P is a crucial step for individuals applying for certain licenses related to tobacco products in New York State. This guide provides a clear, step-by-step approach to completing the form online, ensuring that you provide all necessary information accurately.

Follow the steps to complete the form efficiently.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the legal name of the applicant for the license and provide the Federal Employer Identification Number (FEIN). Be sure to fill in this information accurately to avoid delays.

- Next, fill in your personal information, including your name, social security number, date of birth, home address, and phone number. If you have lived at your current address for less than 10 years, list your previous addresses for the past decade.

- Indicate your title or position in relation to the applicant and detail your role and authority within the business. Check the appropriate boxes to confirm your authorities regarding financial affairs, tax returns, and business operations.

- If you have been known by any other name, indicate 'Yes' and provide the necessary details, including the names and dates used.

- Complete the physical description section by providing your height, weight, sex, eye color, hair color, marital status, country of birth, and citizenship status. Attach additional sheets if necessary.

- If married, include your spouse's name, any other names they have used, their social security number, and home address if different from yours.

- Document your employment history for the past 10 years, including dates of employment and occupation details.

- Indicate how many hours per week you plan on devoting to the business and whether you will engage in any other business activities.

- Provide information regarding any ownership or controlling interest in other businesses, and describe any involvement you have with premises or businesses related to cigarettes or tobacco products.

- If applicable, disclose any past licenses or permits related to the trafficking of cigarettes or tobacco products.

- Confirm whether you and your spouse have filed the required federal and New York State personal income tax returns for the past five years.

- Answer any questions related to tax liabilities and legal convictions, ensuring all responses are truthful and accurate.

- Outline your contributions to the applicant, detailing the nature and value of assets provided.

- Ensure that the information provided is complete and truthful, then sign, date, and include your title before submitting the form.

- After completing all necessary fields, save your changes, download, print, or share the form as required.

Begin filling out the Form CG-100-P online today to ensure your application is complete and accurately submitted.

Beginning Sept. 1, 2023, New York State's cigarette tax will be the highest in the nation. The $1 hike is the first cigarette tax increase since 2010 and changes the tax from $4.35 to $5.35 per pack of 20 cigarettes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.