Loading

Get Tid No:002-tx-

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TID No:002-TX- online

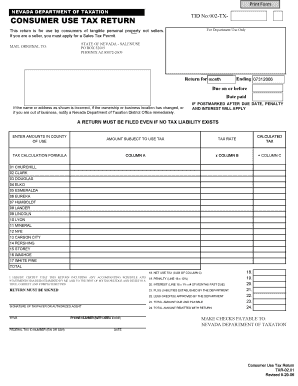

The TID No:002-TX- form is essential for individuals who consume tangible personal property rather than sell it. This guide provides a straightforward, step-by-step approach to help you complete the consumer use tax return online, ensuring compliance with Nevada tax regulations.

Follow the steps to successfully fill out the consumer use tax return.

- Click the 'Get Form' button to access the TID No:002-TX- form and open it for editing.

- Review the form details carefully. Identify the month for which you are filing the return and enter it in the designated field.

- Complete the county line items (lines 1 through 17) by entering the purchase price of the tangible personal property on the appropriate county line.

- For each county, calculate the tax owed by multiplying the amount subject to use tax (Column A) by the tax rate (Column B) to find the calculated tax (Column C).

- In line 18, enter the sum of all calculated tax amounts from Column C.

- If applicable, calculate and enter any penalties and interest due for late payment on lines 19 and 20.

- On line 21, input any liabilities established by the Department of Taxation that are due from prior reporting periods.

- Line 22 is for entering any credits approved by the Department. Ensure that you only include amounts validated by the Department.

- Calculate the total amount due by completing line 23, which requires summing the various amounts entered in previous lines.

- Finally, enter the total amount you are remitting with this return on line 24 and make sure to complete the signature portion of the form.

- Once all information is filled out, save your changes, download, print, or share the completed form as necessary.

Complete your consumer use tax return online to ensure compliance with Nevada tax laws.

The Commerce Tax credit is a non-refundable credit applied toward a Modified Business Tax liability for your business. It equals 50% of the Commerce Tax paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.