Loading

Get Ap 193

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ap 193 online

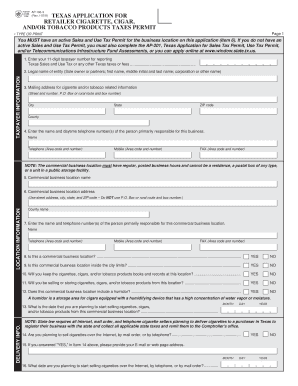

Filling out the Texas Application for Retailer Cigarette, Cigar, and/or Tobacco Products Taxes Permit (Ap 193) is an essential step for businesses intending to sell tobacco products in Texas. This guide provides detailed instructions to help users navigate the form easily and accurately.

Follow the steps to complete the Ap 193 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your 11-digit taxpayer number for reporting Texas Sales and Use Tax or any other Texas taxes or fees in the appropriate section.

- Provide the legal name of the entity, including the names of sole owners or partners as required.

- Fill in the mailing address for cigarette and/or tobacco-related information, ensuring accuracy in the street, city, state, and ZIP code.

- List the name and daytime telephone number(s) of the individual primarily responsible for the business operations.

- Input the name of the commercial business location and provide its complete address.

- Include the name and contact information of the responsible person for the commercial location.

- Indicate whether the provided address is a commercial business location by selecting 'Yes' or 'No'.

- Answer whether this commercial business location is within city limits.

- Specify if you will maintain books and records related to tobacco products at this location.

- Confirm whether you will be actively selling or storing tobacco products at the location.

- Indicate if the commercial business location includes a humidor.

- Provide the date you plan to commence selling tobacco products from the business location.

- Select 'Yes' or 'No' to indicate if you plan to sell products over the Internet, through mail order, or by telephone.

- If applicable, provide your email or web page address.

- State the date you intend to start selling products online or by mail order.

- Confirm if you own vending machines selling tobacco products.

- If applicable, provide the name and mailing address of the vending machine owner.

- Indicate whether you own the products displayed in the vending machines.

- State if you will sell or store tobacco products outside of vending machines.

- Confirm if you will keep business records related to sales at the location.

- For vending machine sales, provide where the business records will be maintained.

- Fill in necessary information for each vending machine, including make, model, and in-service date.

- Indicate if you will sell products from a motor vehicle.

- If applicable, provide specific vehicle information for sales, including the make and model.

- Identify where business records for vehicle sales will be maintained.

- Declare the information provided is accurate by signing the application. Include all necessary names and titles.

- Finally, save changes, download, or print the completed application as needed.

Complete your Ap 193 form online today to ensure compliance with Texas regulations.

To get a retailer permit, you must complete the Texas Application for Retailer Cigarette, Cigar and/or Tobacco Products Permit (AP-193). If you do not have a sales tax permit, complete application AP-201. If you are a sole owner, complete application AP-157.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.