Get Texas Interstate Trucker Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Interstate Trucker Report online

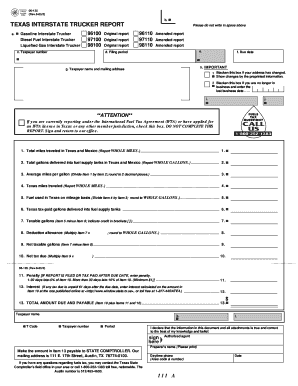

This guide provides a comprehensive overview of how to complete the Texas Interstate Trucker Report form online. Whether you are a seasoned professional or new to filing, this step-by-step approach will ensure you accurately submit your report.

Follow the steps to effectively complete your Texas Interstate Trucker Report.

- Press the ‘Get Form’ button to acquire the Texas Interstate Trucker Report and access it for completion.

- Enter your taxpayer number in section c. This number is essential for identification and must match the one on your fuels tax license.

- Indicate the filing period in section d, specifying the ending month and year of the quarter or year for which you are reporting.

- In section g, provide your complete taxpayer name and mailing address to ensure accurate correspondence.

- Report the total miles traveled in Texas and Mexico in item 1. Ensure to report whole miles only.

- In item 2, list the total gallons delivered into fuel supply tanks in Texas and Mexico, rounding to whole gallons.

- Calculate the average miles per gallon in item 3 by dividing the total miles in item 1 by the gallons in item 2, rounding to two decimal places.

- Item 4 requires you to enter the total miles traveled specifically in Texas, again reporting whole miles.

- For item 5, calculate the fuel used in Texas on a mileage basis by dividing the miles in item 4 by the average miles per gallon from item 3, rounding to whole gallons.

- In item 6, log the total tax-paid gallons delivered into fuel supply tanks in Texas.

- Subtract the number in item 6 from item 5 in item 7 to determine your taxable gallons. Enter the result, using brackets [ ] for any credits.

- In item 8, for liquefied gas, multiply the gallons in item 7 by the applicable deduction allowance, rounding to whole gallons.

- Item 9 requires you to subtract item 8 from item 7 to find your net taxable gallons.

- Calculate the net tax due in item 10 by multiplying item 9 by the current tax rate.

- For item 11, apply any penalties if you are filing late, as specified.

- Enter any interest due in item 12 for unpaid taxes beyond 61 days after the due date, using the rate published online.

- Lastly, add all relevant items in item 13 to determine the total amount due and payable, including any penalties or interest.

- After completing the form, ensure to save changes. You can print, download, or share the report as needed.

Complete your Texas Interstate Trucker Report online today for a seamless filing experience.

You must obtain an End User Number from the Comptroller's office. For Assistance - If you have any questions regarding this registration, filing tax returns or any other tax-related matter, you may contact the Texas State Comptroller's field office in your area or call 1-800-252-1383. AP-197 Dyed Diesel Fuel End User Signed Statement Registration texas.gov https://comptroller.texas.gov › forms texas.gov https://comptroller.texas.gov › forms

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.