Loading

Get Title 36 Mrsa, 681-689

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Title 36 MRSA, 681-689 online

Filling out the Title 36 MRSA, 681-689 form for the Homestead Exemption can be straightforward with the right guidance. This user-friendly guide will help you navigate each section of the form online, ensuring that you provide all necessary information correctly.

Follow the steps to properly fill out the Title 36 MRSA, 681-689 form online.

- Press the ‘Get Form’ button to obtain the document and open it in your browser.

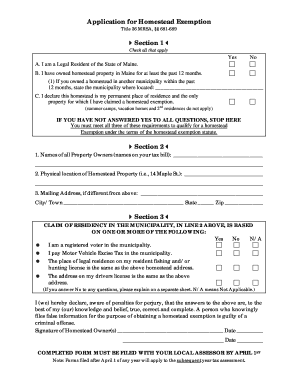

- Begin with Section 13, where you must check all boxes that apply to your situation. Confirm that you are a legal resident of Maine, that you have owned the homestead property for at least the past 12 months, and declare that this property is your permanent residence. If you owned homestead property in a different municipality within the past 12 months, provide that information.

- Move to Section 23, where you must list the names of all property owners as they appear on your tax bill. Next, provide the physical location of your homestead property, including street address. If your mailing address differs from the property address, include that as well, specifying city/town, state, and zip code.

- In Section 33, address the claim of residency based on the provided options. Indicate whether you are a registered voter, if you pay the Motor Vehicle Excise Tax in that municipality, and check if the addresses on your fishing/hunting license and driver's license match your homestead address.

- Finally, review all the information you have entered. Make sure everything is accurate and complete. Sign the form, confirming that the answers provided are truthful and complete to the best of your knowledge. Note the date of signature.

- Once you have filled out the form, save your changes. You can download the document for your records, or print it out. Ensure that the completed form is submitted to your local assessor by April 1st, as returns filed after this date will be applied to the subsequent year.

Take action now by completing your Title 36 MRSA, 681-689 form online for the Homestead Exemption.

To qualify, you must be a permanent resident of Maine, the home must be your permanent residence, you must have owned a home in Maine for the twelve months prior to applying and an application must be filed on or before April 1 with the municipality where the property is located.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.