Loading

Get 2004 Form Mo-1040a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 FORM MO-1040A online

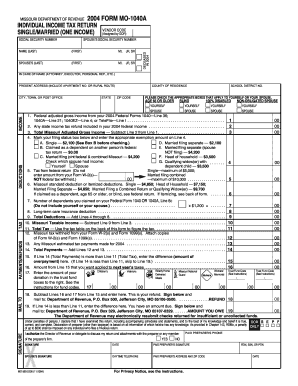

Filling out the 2004 FORM MO-1040A is an essential step for individuals filing their Missouri income tax return. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete your FORM MO-1040A online:

- Press the ‘Get Form’ button to access the 2004 FORM MO-1040A and open it in your preferred online editor.

- Fill in your name in the designated area, ensuring you provide your last name, first name, and middle initial. If applicable, also provide your spouse's name.

- Enter the social security numbers for both you and your spouse in the corresponding fields.

- Complete the present address section by including your street address, city, state, county of residence, and ZIP code.

- Indicate your age status, blindness, and any other relevant boxes that apply to you or your spouse.

- For income, input your federal adjusted gross income on Line 1. This amount can be derived from your federal forms: 1040, 1040A, or 1040EZ.

- Subtract any state income tax refund included in your 2004 federal income from Line 1 and record the total on Line 3.

- Select and mark your filing status from the various options available and enter the appropriate exemption amount on Line 4.

- Calculate your total deductions from Lines 4 through 8 and enter the result on Line 9.

- Determine your Missouri taxable income by subtracting Line 9 from Line 3, documenting the amount on Line 10.

- Refer to the tax table to calculate your total tax, inputting the figure on Line 11.

- Input any Missouri tax withheld from your W-2 and 1099 forms on Line 12, attaching copies as required.

- Add any estimated tax payments made for 2004 on Line 13, then compute your total payments on Line 14.

- If Line 14 exceeds Line 11, enter the overpayment on Line 15 and indicate any amount you wish to apply to next year’s taxes on Line 16.

- Complete any donations to trust funds as indicated on Line 17.

- Finalize your form by signing and dating it in the designated area. Ensure to check your calculations and attach all required documentation before submission.

- Save your changes, and then download, print, or share the completed form as necessary.

Complete your 2004 FORM MO-1040A online today to ensure timely and accurate filing.

Form 1040-A: U.S. Individual Tax Return For instance, if you couldn't use Form 1040-EZ because you had dependents to claim, you would have been able to use 1040A if: You file as single, married filing jointly or separately, qualifying surviving spouse, or head of household. Your taxable income was less than $100,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.