Loading

Get Form Dcc-1 Document Control Center Request Form. Request For Prior Year Tax Returns

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form DCC-1 Document Control Center Request Form. Request for Prior Year Tax Returns online

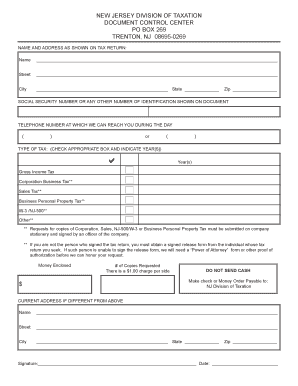

The Form DCC-1 Document Control Center Request Form is designed to help users request prior year tax returns efficiently. This guide provides a detailed, step-by-step approach to ensure that you fill out the form correctly and submit it online with confidence.

Follow the steps to complete your request form

- Press the ‘Get Form’ button to access the form and open it in your preferred online document management tool.

- Enter your name and address as shown on your tax return in the designated fields. Make sure to include your street address, city, state, and zip code.

- Provide your social security number or any other identification number that appears on your tax documents to help verify your identity.

- Fill in your daytime telephone number to ensure that the tax office can reach you regarding your request. You may provide two numbers if necessary.

- In the section designated for the type of tax, check the appropriate box and indicate the year(s) for which you are requesting returns. Make sure to review the options thoroughly.

- If you are requesting tax return copies for a corporation, sale, or other specified taxes, remember to use company stationery and have it signed by a corporate officer.

- If you are not the individual who signed the tax return, secure a signed release form from that person. If they cannot sign, you will need a 'Power of Attorney' form or proof of authorization.

- Indicate the total number of copies you are requesting and calculate the fees accordingly, noting that there is a charge of $1.00 per side. Do not send cash; instead, prepare a check or money order made payable to 'NJ Division of Taxation.'

- If your current address differs from the address you provided above, fill in the current name and address fields completely.

- Finally, remember to sign and date the form before submitting it. This confirms that the information you provided is accurate and complete.

Complete your Form DCC-1 Document Control Center Request Form online today to obtain your prior year tax returns!

You can: check your Income Tax estimate and tax code. fill in, send and view a personal tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.