Loading

Get De88 Form Printable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the De88 Form Printable online

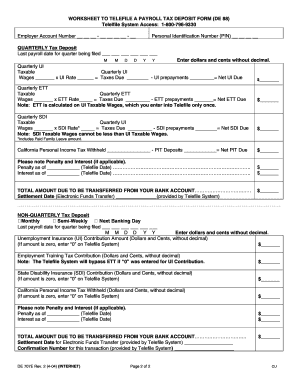

Filling out the De88 Form Printable is an essential task for employers to report their payroll tax deposits accurately. This guide provides clear instructions on how to complete the form effectively, ensuring that you meet all necessary requirements.

Follow the steps to fill out the De88 Form Printable online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer account number in the designated field. This number is crucial for the identification of your account and should be formatted as XXX-XXXX.

- Input your personal identification number (PIN) where requested. This number adds an additional layer of security to your filing process.

- Indicate the last payroll date for the quarter being filed in the format MM/DD/YYYY. This information is vital for accurate reporting.

- For Quarterly Unemployment Insurance (UI), enter the taxable quarterly UI wages. Next, multiply this amount by the UI rate provided to calculate the total taxes due. Remember to subtract any UI prepayments to find the net UI due.

- Repeat the calculation for the Employment Training Tax (ETT) section, ensuring you follow the same steps to enter taxable quarterly ETT wages and deduct prepayments.

- For the State Disability Insurance (SDI), perform the same calculations as above. The amount entered should be calculated based on UI taxable wages.

- Document the California personal income tax withheld. Deduct any PIT deposits to obtain the net PIT due.

- If applicable, note any penalties and interest as of the telefile date, and input these amounts accurately.

- Total all amounts due to be transferred from your bank account and ensure this is correct before submission.

- Lastly, when you have filled in all necessary fields, you can save changes, download, print, or share the form as required.

Complete your De88 Form Printable online today to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Employers must withhold 1.1% of their employees' gross wages for CASDI tax. The wage base limit is $145,600 per employee, per calendar year, and the maximum amount that can be withheld for each employee is $1,601.60.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.