Loading

Get Ca Form Boe 517 Ext

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca Form Boe 517 Ext online

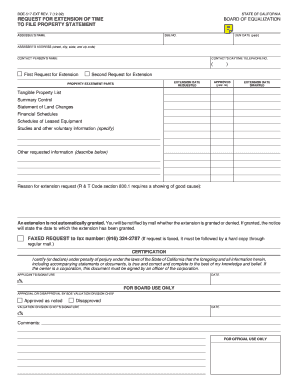

Filling out the Ca Form Boe 517 Ext online is a straightforward process that allows users to request an extension of time to file a property statement. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your form online.

- Click the ‘Get Form’ button to obtain the Ca Form Boe 517 Ext and open it in your editor.

- Enter the assessee’s name in the designated field.

- Specify the lien date by entering the appropriate year.

- Fill in the SBE number as required.

- Provide the assessee’s address, including street, city, state, and zip code.

- Input the contact person’s name who will be responsible for this request.

- Enter the contact’s daytime telephone number for follow-up.

- Indicate whether this is the first or second request for an extension.

- Specify the extension date you are requesting in the relevant field.

- Indicate if the property statement parts are approved by checking 'yes' or 'no'.

- List the items associated with the property statement, including any other requested information.

- Provide a reason for the extension request, ensuring to show good cause as outlined in R & T Code section 830.1.

- Certify the information provided by signing the application and including the date.

- Once all fields are completed, you can save changes, download, print, or share the form as needed.

Complete your request for an extension online by following these steps.

Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year. If you do not receive the original bill by November 1, contact the County Tax Collector or Assessor for a duplicate bill. Note, the original bill may still have the prior owner's name on it the first year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.