Loading

Get Form C-107, Tax Tables For Succession And Transfer Taxes. Form C-107, Tax Tables For Succession And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form C-107, Tax Tables For Succession And Transfer Taxes online

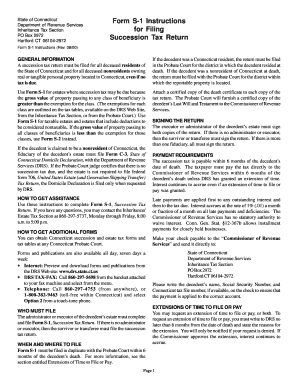

Filling out the Form C-107 is essential for determining the tax obligations related to succession and transfer taxes. This guide provides a straightforward approach to completing this form, ensuring that you provide accurate information while navigating each necessary section with confidence.

Follow the steps to fill out the Form C-107 accurately.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editing application.

- Begin by entering the identification section of the form. Provide your name, address, and any necessary tax identification details.

- Move to the tax tables provided in the form. Identify the relevant class (AA, A, B, or C) for the beneficiaries receiving property and note the corresponding exemption amounts.

- For each class of beneficiary, fill in the net taxable amount passing to them as per the tax tables. This will involve reviewing the gross value of properties included in the estate.

- Calculate the tax due based on the values entered. Use the tax percentages provided in the table for each applicable class of beneficiary.

- Document any deductions in accordance with allowable expenses associated with the estate, following the guidelines laid out in the form instructions.

- Review the entire form for completeness, ensuring that all required fields are filled and calculations are accurate.

- Once satisfied with your entries, save your changes, download, print, or share the completed form as necessary.

Get started on your Form C-107 online today to ensure compliance with your tax obligations.

The tax is currently calculated at a flat rate of 40% (equal to the estate and gift tax rate) on transfers above the lifetime GST tax exemption amount ($12.92 million per individual in 2023). The exemption amount will grow each year based on inflation through 2025.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.