Loading

Get Lgl-002, Request For Disclosure Of Tax Return Or Tax Return ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

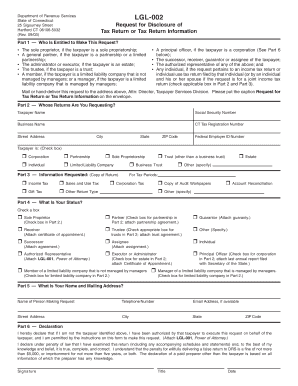

How to use or fill out the LGL-002, Request for Disclosure of Tax Return or Tax Return Information online

Filling out the LGL-002 form is crucial for individuals and entities seeking access to tax return information. This guide will provide you with clear step-by-step instructions on how to complete the form online to ensure a smooth and efficient process.

Follow the steps to complete the LGL-002 form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin filling out Part 1, which identifies who is entitled to make the request. Check the appropriate box if you are the sole proprietor, partner, administrator, trustee, member, officer, or authorized representative.

- Proceed to Part 2 and enter the details of the taxpayer whose returns you are requesting. Include the taxpayer's name, social security number, business name, CT tax registration number, street address, city, state, ZIP code, and federal employer ID number. Be sure to check the box that corresponds to the taxpayer's type.

- In Part 3, indicate the specific information requested. Check the boxes for the types of returns (e.g., income tax, sales and use tax, gift tax) and specify any required details about the tax periods or other relevant documents.

- Fill out Part 4 by indicating your status. Select the box that applies to you, such as sole proprietor, receiver, successor, authorized representative, or other roles, and attach any necessary documentation.

- In Part 5, provide your name and mailing address. Include your telephone number and email address, if available, to ensure you can be contacted regarding the request.

- Complete Part 6 by signing the declaration. Confirm that you are authorized to make the request on behalf of the taxpayer and understand the penalties for providing false information.

- Finally, review the filled form for accuracy. Once you have verified all information, save your changes, and download, print, or share the completed form as needed.

Complete the LGL-002 form online today to ensure you access the necessary tax return information efficiently.

If you are a resident and you meet the requirements for Who Must File a Connecticut Resident Return for the taxable year, you must file Form CT-1040, Connecticut Resident Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.