Loading

Get Forms & Publications - Board Of Equalization - Ca.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forms & Publications - Board Of Equalization - CA.gov online

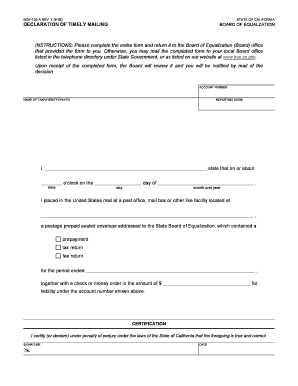

This guide provides clear, step-by-step instructions on how to complete the Declaration of Timely Mailing form for the Board of Equalization in California. Whether you are new to this process or seeking to ensure your submission is correct, this expert analysis will support you in filing the form accurately and efficiently.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the account number as required at the top of the form. This number is essential for processing your form accurately.

- Enter the name of the taxpayer or fee payer in the designated field. Ensure that the name matches the records held by the Board.

- Indicate the reporting basis applicable to your submission. This helps clarify the nature of the form's purpose.

- Complete the declaration section by stating the date and time you mailed the form. Use the correct format for clarity.

- Provide the detailed mailing address where you placed the envelope in the postal system. Include all relevant information to avoid mail delivery issues.

- Specify if this submission contains a tax return or a fee return and indicate the period it covers.

- Include the payment amount in the appropriate section. This should reflect the check or money order enclosed with your form.

- Sign and date the form in the certification section. Your signature is necessary to validate the information provided.

- Review the entire form for accuracy before finalizing your submission. Make sure all fields are completed correctly.

- Save your changes, and then download, print, or share the form as necessary for your records or to submit to the Board.

Complete your documentation online to ensure timely and accurate processing.

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.