Loading

Get Kw5

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

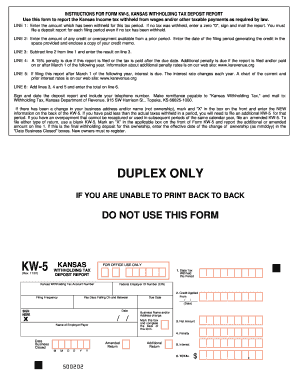

How to fill out the KW-5 online

Filling out the KW-5 form is an important step in reporting Kansas withholding taxes. This guide will provide you with clear, step-by-step instructions to ensure you complete the form correctly and efficiently.

Follow the steps to complete your KW-5 form accurately.

- Click 'Get Form' button to obtain the KW-5 form and open it in the editor.

- In 'Line 1', enter the amount of Kansas income tax withheld for the reporting period. If no tax was withheld, simply enter '0', sign the report, and submit it.

- For 'Line 2', indicate any credit or overpayment from a previous period, and enter the corresponding date of that filing period. Make sure to attach a copy of your credit memo.

- On 'Line 3', perform the calculation by subtracting the amount on Line 2 from Line 1. Enter this result on Line 3.

- In 'Line 4', be aware that a 15% penalty applies if the report is submitted or the tax is paid after the due date. Additional penalties may accrue if the report is filed on or after March 1 of the following year, as detailed on the appropriate website.

- 'Line 5' requires you to enter any interest due if the report is filed after March 1 of the subsequent year. Refer to the specified website for current interest rates.

- Add the totals from Lines 3, 4, and 5, and enter this on Line 6.

- Sign and date the deposit report, and include your telephone number. Make the payment payable to 'Kansas Withholding Tax' and mail it to the appropriate address.

- If there has been a change in your business name or address, mark the designated box and complete the back of the form with the new information.

- For any additional KW-5 filings or amendments, use a blank form and replace the necessary details.

Complete your KW-5 form online today to ensure timely reporting of your withholding taxes.

Go to the Kansas Department of Revenue Customer Service Center and create your account. Contact Electronic Services for your Access Code assignment. Connect your tax account to your login and begin filing. Submit a Form EF-101, Authorization for Electronic Funds Transfer (ACH Credit* payers only.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.