Loading

Get Form 3885l

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3885l online

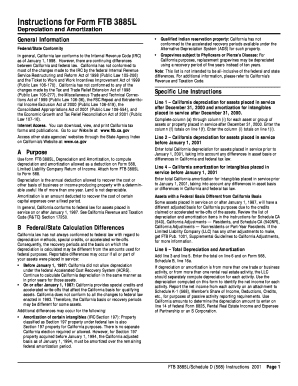

Filling out Form 3885l online can streamline the process of calculating depreciation and amortization for your limited liability company. This guide is designed to provide clear and supportive instructions to help users of all experience levels successfully complete the form.

Follow the steps to complete the Form 3885l online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Begin by filling out the general information section, ensuring that you include all relevant details about your limited liability company (LLC). This information is crucial for proper processing.

- In Line 1, enter California depreciation for assets placed in service after December 31, 2000, and amortization for intangibles placed in service after December 31, 2000. Fill out columns (a) through (i) for each asset or group, and ensure you include totals in columns (f) and (i).

- Line 2 requires you to enter total California depreciation for assets placed in service prior to January 1, 2001. Be sure to consider any differences in asset basis or state tax law.

- For Line 4, input total California amortization for intangibles placed in service before January 1, 2001, taking into account any differences relevant to California and federal law.

- In Line 6, add the totals from Lines 3 and 5 to arrive at the total depreciation and amortization. Enter this total on both Line 6 of the form and on Form 568, Schedule B, Line 16a.

- Line 7 requires the Internal Revenue Code (IRC) Section 179 expense election amount. This involves completing the relevant worksheet while ensuring your totals are accurate.

- After completing all sections, review the form for accuracy. Once satisfied, you can save your changes, download, print, or share the completed form as needed.

Complete your Form 3885l online today for an efficient tax filing experience.

Use Form 4562 to: Claim your deduction for depreciation and amortization.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.