Loading

Get New Start - Ez Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NEW START - EZ RETURN online

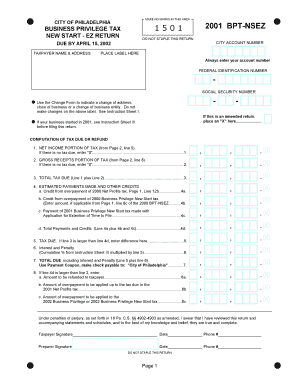

Filling out the NEW START - EZ RETURN can be a straightforward process if you follow systematic steps. This guide provides detailed instructions on how to accurately complete this online form to ensure compliance with the City of Philadelphia's Business Privilege Tax requirements.

Follow the steps to successfully complete the NEW START - EZ RETURN online.

- Press the ‘Get Form’ button to access the form and display it in your editing interface.

- Enter your city account number in the designated area on the form. This number is crucial for identifying your tax record.

- Fill in your taxpayer name and address, using the provided label. If any changes to your business address, entity, or closure are necessary, use the Change Form as specified.

- Indicate whether this is an amended return by marking an 'X' in the appropriate box.

- Proceed to the tax computation sections. Complete the net income portion from the corresponding lines on Page 2, ensuring to enter '0' if there’s no tax due.

- Similarly, complete the gross receipts portion of tax by referencing the specific lines from Page 2, again entering '0' if applicable.

- Calculate the total tax due by adding Lines 1 and 2, and move on to document any estimated payments or credits in the following fields.

- Complete the final tax due calculation by subtracting total payments and credits from your total tax due.

- If there is an overpayment, enter the amount to be refunded or applied to other taxes as indicated.

- Lastly, sign and date the form in the appropriate spaces designated for the taxpayer and preparer, ensuring that you include contact numbers if applicable. Make sure not to staple the return.

Complete your NEW START - EZ RETURN online today to ensure timely submission.

Related links form

You could use Form 1040-EZ if all of the following apply: You file as single or married filing jointly. Your taxable income was less than $100,000. You don't claim any dependents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.