Loading

Get Naag/nasco Standardized Reporting

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NAAG/NASCO Standardized Reporting online

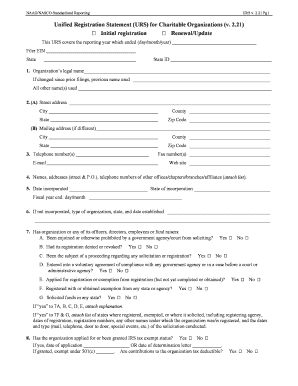

Filling out the NAAG/NASCO Standardized Reporting form is an essential process for charitable organizations. This guide provides clear, step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to successfully fill out the form.

- Press the ‘Get Form’ button to obtain the form and open it in the designated editing platform.

- Begin by entering the organization’s legal name in the first field. If applicable, provide the previous name used in the designated section.

- Fill in the street address, city, county, state, and zip code in section 2(A). If the mailing address differs, complete section 2(B) with the needed details.

- Provide the organization's telephone and fax numbers, website, and email address in section 3.

- List the names, addresses, and telephone numbers of other offices or branches in section 4.

- In section 5, indicate the date of incorporation and the state of incorporation. Also, provide the fiscal year end date.

- If not incorporated, specify the type of organization, state, and date established in section 6.

- In section 7, answer the questions regarding any prohibitions, denials, or solicitations related to the organization. Attach explanations if necessary.

- Indicate whether the organization has applied for or been granted IRS tax-exempt status in section 8 and provide the necessary dates.

- Specify the methods of solicitation in section 10.

- Provide the relevant NTEE code(s) in section 11 that represent your organization accurately.

- Detail the purposes and programs of the organization in section 12, attaching a separate sheet if needed.

- List the names, titles, addresses, and phone numbers of key personnel in section 13, attaching a separate sheet if necessary.

- In section 14, respond to questions about relationships among officers and convictions, attaching explanations if required.

- Attach a separate sheet with information about individuals responsible for funds and their custody in section 15.

- Provide the name and contact information of your accountant or auditor in section 16.

- Complete section 17 by providing the information of the person authorized to receive service of process.

- In section 18, indicate whether the organization receives financial support from other nonprofit organizations and any other owned interests.

- Detail whether volunteers or professionals are used for solicitation in section 19.

- Complete section 20 if the organization contracts with fundraising professionals, providing their details as required.

- Enter the financial contributions and costs from the previous year in section 22.

- Finally, ensure all sections are completed accurately, and save your changes. You have the option to download, print, or share the form as necessary.

Now that you have this guide, begin filling out the NAAG/NASCO Standardized Reporting online to complete your registration successfully.

Under the Charleston Principles, a charitable organization that has its principal place of business in the state (and is thus “domiciled” in the state) and uses the internet to solicit contributions in that state must register in that state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.