Loading

Get Rmft 11 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rmft 11 A online

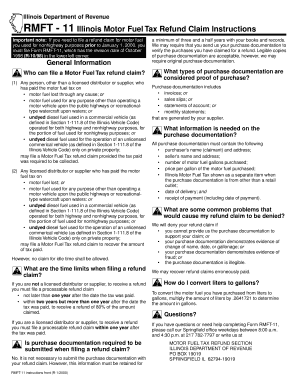

Filing the Rmft 11 A online is a straightforward process designed to assist individuals seeking a motor fuel tax refund. This guide provides step-by-step instructions to ensure you accurately complete the form and submit your claim efficiently.

Follow the steps to complete the Rmft 11 A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the period covered by this claim. Print the month and year that your refund claim covers. If you previously filed a refund claim, please indicate the date you filed it.

- Identify yourself by printing your name or business name and your address. Also, print your federal employer identification number (FEIN) or your Social Security number (SSN) where indicated. Include your telephone number.

- Describe how you used the motor fuel. Indicate both the location of use and the purpose. If more space is needed, attach a separate sheet.

- Figure your refund by following the specific instructions provided for lines 13 to 25 on the form.

- Describe the motor fuel used for highway purposes. Report the total number of highway miles traveled during the claim period, and specify any stored gallons of fuel.

- Describe the undyed diesel fuel you used for nonhighway purposes, following the instructions for lines 26 to 35 on the form.

- Itemize your equipment. Detail each piece of equipment used with separate entries. Attach an extra sheet if necessary, and include calculations for each column as specified.

- Sign and date your refund claim.

- Once completed, make two copies of your refund claim—one for your records and one for mailing. Send the original and one copy to the Illinois Department of Revenue, Motor Fuel Tax Refund Section at the specified address.

Start filling out your Rmft 11 A online for a smooth refund process.

Applying online is quick and easy! If you already have an Illinois IFTA license, login to MyTax Illinois or click "Sign up Now" to create your account. New IFTA Carriers that do not have an Illinois IFTA license yet can apply online with MyTax Illinois without having to login.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.