Loading

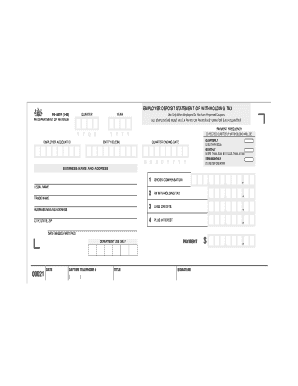

Get Employer Deposit Statement Of Withholding Tax (pa-501r). Forms/publications

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employer Deposit Statement Of Withholding Tax (PA-501R) online

The Employer Deposit Statement Of Withholding Tax (PA-501R) is an important document for employers to report tax withholdings. This guide will provide you with clear and detailed instructions on how to effectively fill out the form online.

Follow the steps to accurately complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the employer account ID in the designated field. This ID is essential to link the form to your business records.

- Indicate the year you are reporting. Use the provided fields to enter the four-digit year.

- Select the quarter for which you are reporting. Choose from the provided options that best fit your reporting schedule.

- Fill in the business name and address, ensuring that the legal name and trade name are accurate. This identification is crucial for correct processing.

- Input the gross compensation amount in the appropriate field. This represents the total wages paid to employees during the quarter.

- Enter the total amount of Pennsylvania withholding tax collected from the gross compensation.

- List any allowable credits in the designated section. This may include previous overpayments or adjustments that reduce your total tax liability.

- Add any interest charges applicable to your payment, if necessary.

- Review all entered information for accuracy, and ensure that every required field is completed.

- Lastly, provide your daytime telephone number and title, sign the form, and submit it as per the instructions outlined.

- Save your changes, download, print, or share the completed form as needed for your records.

Complete your Employer Deposit Statement Of Withholding Tax online today to ensure compliance and accurate reporting.

Register for Employer Withholding online by visiting mypath.pa.gov. Registering online allows business owners to withhold employer taxes with the Pennsylvania Department of Revenue and open Unemployment Compensation accounts administered by the Pennsylvania Department of Labor & Industry.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.