Loading

Get Inheritance Transfer Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inheritance Transfer Form online

This guide provides clear instructions on how to fill out the Inheritance Transfer Form online. By following the steps outlined below, you can ensure that your form is accurately and completely submitted, aiding in the timely processing of your inheritance transfer requests.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the Inheritance Transfer Form and open it for online completion.

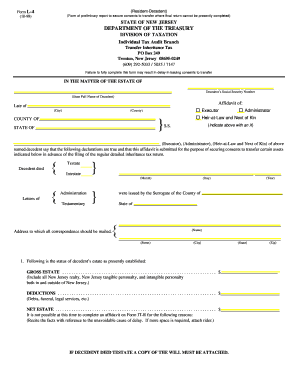

- Begin filling out the form by providing the decedent's full name and Social Security Number in the designated fields at the top of the document.

- Specify the county and state where the decedent was a resident prior to their passing. This information is crucial for the processing of the form.

- Select the appropriate role by checking the correct box to indicate whether you are the Executor, Administrator, or Heir-at-Law and Next of Kin.

- Provide the date on which the Letters of Administration or Letters of Testamentary were issued. This includes entering the month, day, and year of issuance.

- Fill in the address where all correspondence should be mailed, including street, city, state, and zip code, ensuring it is complete and accurate.

- Report the status of the decedent's estate by entering figures for the gross estate, deductions, and net estate in the respective fields.

- If applicable, detail any transfers made by the decedent during their lifetime without receiving full consideration, including dates and descriptions.

- List any New Jersey real estate owned by the decedent as well as their assessed and market values, including any encumbrances.

- Document all stocks and bonds associated with New Jersey corporations registered in the decedent's name, providing the market values.

- Include the details of any funds held in State and National Banks in New Jersey, specifying the name of the bank, date of death, and current balance.

- Identify the relationship to the decedent of all individuals entitled to share in the estate, listing their names and addresses.

- Indicate the items for which consents to transfer are desired in the relevant section.

- Provide your home address in the specified area to ensure accurate documentation.

- Finally, review and confirm that all information is complete and accurate. You can save changes, download, print, or share the completed form as needed.

Ensure your inheritance transfer requests are handled promptly by completing your Inheritance Transfer Form online today.

The Transfer Inheritance Tax is a transfer tax imposed on property that is valued at $500 or more, and that passes from a decedent to the decedent's beneficiary. The tax rate ranges from 11% to 16%, and is imposed based upon the relationship between the decedent and the heir.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.