Loading

Get Ow-9-b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OW-9-B online

Filling out the OW-9-B form online can seem daunting, but it is a straightforward process when you break it down into manageable steps. This guide will walk you through each section of the form to ensure you provide accurate information for your tax reporting.

Follow the steps to complete the OW-9-B form online.

- Click ‘Get Form’ button to obtain the OW-9-B form and open it in the editor.

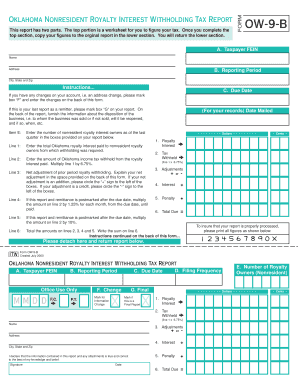

- In section A, input your taxpayer FEIN, name, and address. Ensure all details are accurate to avoid any processing issues.

- For section B, select the reporting period for which you are filing this report. This is important for accurate tax calculations.

- In section C, enter the due date for this tax report submission. This helps you keep track of your deadlines.

- If there are any changes to your account, for example an address change, mark the ‘F’ box and detail these changes on the back of the form.

- If this is your last report as a remitter, mark the ‘G’ box and provide information about the disposition of your business on the back of the form.

- In section E, record the number of nonresident royalty interest owners as of the last quarter.

- Line 1 requires you to enter the total Oklahoma royalty interest paid to nonresident royalty owners from which withholding was required.

- On line 2, calculate and enter the amount of Oklahoma income tax withheld by multiplying line 1 by 6.75%.

- For line 3, make a net adjustment of prior period royalty withholding and explain it in the space provided on the back of the form. Indicate if it is an addition or a credit.

- Line 4 is to record any interest due by entering the appropriate amount.

- Line 5 should reflect any penalties that are due if the report is submitted after the due date.

- Finally, total the amounts on lines 2, 3, 4, and 5, and write the sum on line 6. This is the total amount due.

- Review all filled sections and ensure all figures are printed clearly. Once completed, save your changes, then download, print, or share the form as required.

Complete your OW-9-B form online today to ensure timely and accurate tax reporting.

An individual's withholding allowance amount is the Oklahoma individual income tax personal exemption amount of $1,000 divided by the number of payroll periods in the calendar year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.