Loading

Get Ohio It 942

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio It 942 online

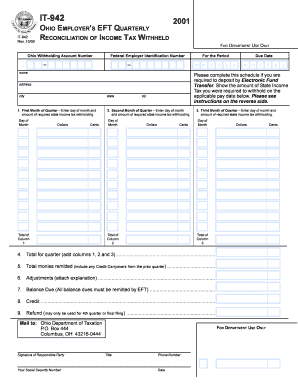

Filling out the Ohio IT 942 form is essential for employers to report and reconcile income tax withheld from employees. This guide will provide clear and comprehensive instructions to help users accurately complete the online form with confidence.

Follow the steps to successfully complete your Ohio IT 942 form

- Press the ‘Get Form’ button to retrieve the Ohio IT 942 form and open it in the editor.

- Enter your Ohio withholding account number and federal employer identification number at the top of the form. Ensure both numbers are accurate and match your records.

- In the first month of the quarter, enter the day of the month and the amount of state income tax withholding required. This amount should reflect the taxes withheld from your employees' earnings.

- Repeat the process for the second month of the quarter. Again, include the day of the month and the corresponding withholding amount.

- For the third month of the quarter, document the day of the month and the income tax withholding amount as with the previous months.

- Calculate the total of the amounts from each month by summing columns 1, 2, and 3. This total will be recorded in the designated field for the total withheld amount for the quarter.

- Fill in the total monies remitted, which includes any Credit Carryovers from the prior quarter.

- If applicable, include any adjustments that may be necessary and attach an explanation if required.

- Indicate the balance due, keeping in mind that all balance dues must be remitted by electronic funds transfer.

- If applicable, fill in the credit and refund sections. Note that refunds may only be used for the fourth quarter or final filing.

- Once all sections are complete, review the entire form for accuracy and completeness before signing it as the responsible party.

- Save your changes, and if necessary, download, print, or share the completed form based on your requirements.

Complete your Ohio IT 942 form online today to ensure your tax obligations are met accurately and on time.

Because Ohio collects a state income tax, your employer will withhold money from your paycheck for that tax as well. As mentioned above, Ohio state income tax rates range from 0% to 4.797% across six brackets. The same brackets apply to all taxpayers, regardless of filing status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.