Loading

Get Tax Declaration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Declaration online

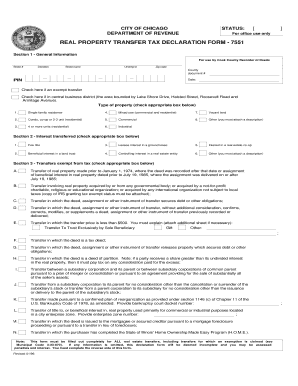

Filling out the Tax Declaration form online is an essential part of the real property transfer process. This guide provides clear and supportive instructions to help users complete each section of the form accurately and efficiently.

Follow the steps to complete your Tax Declaration form online.

- Click ‘Get Form’ button to obtain the Tax Declaration and open it in your online editor.

- In Section 1, fill in the general information. Include your street number, street name, unit or apartment number, zip code, county, document number, and PIN. Check the box if the transfer is exempt or if it's in the central business district. Then, select the type of property from the provided options.

- Proceed to Section 2 to specify the interest being transferred. Check the appropriate box based on your situation, such as fee title, beneficial interest, or other types of interest.

- In Section 3, indicate any exemptions from tax by checking the applicable boxes. Each exemption category provides specific scenarios, so choose the one that fits your transfer situation.

- Complete Section 4 with additional transfer information. Enter the date of delivery or recording, note if any part of the transfer price consists of non-cash consideration, and confirm whether any part of the price is contingent on future events.

- Move on to Section 5 to compute the tax stamps purchased. Begin with the transfer price, follow the calculations for dividing and multiplying as instructed, and document any penalties or interest as necessary.

- In Section 6, complete the attestation statements for both seller and buyer. Each party must print their name, title, sign, and include their mailing address and daytime phone number.

- Finally, in Section 7, check if a building registration certificate is required, and if applicable, indicate whether registration is not required. Fill out Section 8 with the appropriate filing instructions based on the recording requirement and ensure to purchase transfer stamps.

- Once all sections are complete, save your changes, download or print the filled form for your records or further submission.

Begin the process of completing your Tax Declaration online today.

There's no limit on the amount your tax refund can be. However, in some cases, high-value tax refunds may be sent as a paper check instead of a direct deposit. The IRS doesn't publish the threshold for when a check is issued instead of a direct deposit, but it does limit direct deposits to three deposits per account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.