Loading

Get It 40es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-40ES online

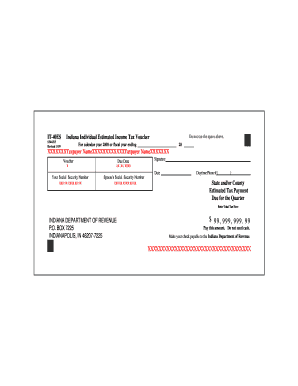

The IT-40ES form is a crucial document for Indiana residents to submit their estimated income tax payments. This guide provides clear instructions on completing the form online, ensuring a smooth filing experience.

Follow the steps to complete your IT-40ES form online.

- Click 'Get Form' button to access the IT-40ES form and open it in your preferred online editing tool.

- Fill in your taxpayer name in the designated space. Ensure that the name matches the records held by the Indiana Department of Revenue.

- Enter your Social Security number in the appropriate field. This number is critical for identification and processing.

- Indicate the due date for your estimated tax payment. This date is essential to avoid penalties for late submission.

- If applicable, provide your spouse's Social Security number in the specified area. This step is necessary for joint filers.

- Input the estimated tax payment due for the quarter. Be sure to calculate the amount accurately based on your income projections.

- In the 'Enter Total Tax Here' section, record the total amount you are sending to the Indiana Department of Revenue. Double-check to confirm the correctness.

- Review all entered information for accuracy before finalizing your form. This ensures that any errors do not delay processing.

- Once complete, save your changes, then choose to download, print, or share the IT-40ES form according to your needs.

Complete your IT-40ES form online today to ensure timely and accurate tax payments.

You must pay advance tax before the financial year ends in 4 instalments: 15th June, 15th September, 15th December and 15th March. If advance tax is not paid ing to this schedule, then 1% monthly interest will be levied.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.