Loading

Get Rct 101 I

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rct 101 I online

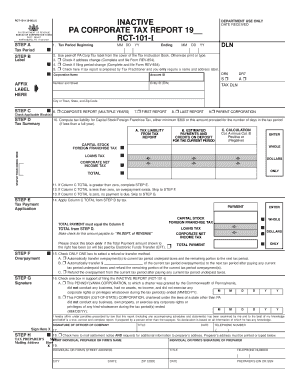

The Rct 101 I is an important document for corporations in Pennsylvania that had no business activity during a specific tax period. This guide will provide clear, step-by-step instructions for filling out the Rct 101 I online, ensuring that all users can effectively complete the form with ease.

Follow the steps to successfully fill out the Rct 101 I online.

- Use the ‘Get Form’ button to initiate the process of obtaining the Rct 101 I form and open it in your preferred editing tool.

- Begin with Step A by entering the tax period start and end dates, using the appropriate fields for year, month, and day.

- Affix your Pennsylvania Corporation Tax label from the cover of the accompanying Tax Instruction Book, or print/type your corporation's information if a label is unavailable.

- Indicate if there has been an address change or filing period change by checking the relevant boxes, and complete Form REV-854 if necessary.

- If your tax report is prepared by a tax practitioner, check the corresponding box and provide the necessary identification for the corporation.

- In Step D, check applicable blocks for different report types, like composite reports, first reports, last reports, or parent corporation.

- In the Tax Summary section, compute your tax liability for Capital Stock and Foreign Franchise Tax. Enter the relevant amounts in the designated fields.

- Complete the payment application section based on the tax calculations from Step D, ensuring all totals align with your tax liability.

- If there's an overpayment, follow Step E to select a refund or transfer method; if not, proceed to Step G.

- Sign and date the form in Step G, including your title and phone number for verification.

- In Step H, provide the preparer's details if applicable, and confirm the mailing address for the settlement notice.

- Review the checklist to ensure all necessary information is correct before submission.

- Upon completing all sections, save your changes, and you may download, print, or share the form as needed.

Start filling out your Rct 101 I online to ensure compliance with Pennsylvania tax regulations.

The rate of the tax is 9.99 percent of every income that is taxable by Pennsylvania, which is essentially every income that is taxable by the federal government before deductions. Form RCT-101, PA Corporate Tax Report, is the form to be submitted.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.